How Inequality Distorts Economics

How Inequality Distorts Economics

The growing global concentration of wealth has made basic data on household savings, the trade deficit, and overseas assets increasingly unreliable.

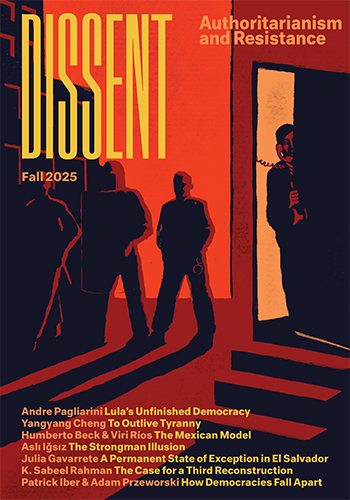

One of the urgent challenges facing the Biden administration is reversing the ever-worsening maldistribution of wealth. The more billionaires we have, and the more zeroes added to the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg, the less there is for everyone else. The only way to lift people out of poverty and economic insecurity is to claw back money from the very wealthy. But there is a political imperative as well. Oligarchic wealth is deeply destructive of democratic governance. Around the globe, most oligarchs have been faithful cheerleaders for autocratic rule. Four years of Donald Trump’s subversion of democracy was not just a bad dream; it will be our future if we fail to rein in excessive wealth.

Oligarchic wealth also poses another, even greater danger: it undermines the stability and health of the global economy.

Not enough attention has been paid to this aspect of the story. In his two brilliant and pioneering volumes on inequality—Capital in the Twenty-First Century (2014) and Capital and Ideology (2020)—Thomas Piketty mainly focuses on the fundamental injustice of oligarchic capitalism and the falseness of the ideologies that justify it. He devotes relatively few words to the horrendous economic consequences of growing wealth inequality. But new strands of scholarship are showing the profound economic irrationality of concentrating vast wealth in the hands of oligarchs.

Many economists had embraced the idea that a “great moderation,” which lasted from 1980 to 2007, signaled that global capitalism had overcome the boom-and-bust cycles of the past. The unexpected severity of the 2008–2009 global financial crisis has led to a rethinking.

In particular, analysts are starting to recognize that the greed of oligarchic elites has inadvertently corrupted some of the key economic indicators on which economists rely. The misleading data has, in turn, made it significantly harder to recognize the profound distortions created by the growing concentration of wealth. There are three distortions that are particularly relevant: on household savings, the trade deficit, and overseas assets.

U.S. Household Saving

U.S. government data shows that through the Great Recession, personal saving in the United States had been trending steadily downward (see chart below). This downturn, which began in the 1970s, was often cited to justify tax cuts for high-income households (I wrote about this trend in the Review of Radical Political Economics in 1995). The argument was that low household saving led to inadequate private-sector investment. In order to stimulate more business investment, it was necessary to lower taxes on the rich.

However, after the Reagan (1981) and Bush (2001 and 2003) tax cuts, the personal saving rate continued to decline. This should have generated serious questions about the data, because it is obvious that rich people are able to save a far larger share of their income than millions of people who live paycheck to paycheck. Moreover, Piketty and Emmanuel Saez have shown that, between 1981 and 2018, the share of income going to the top 1 percent of households in the United States rose from 8 percent to more than 18 percent. It would require unrelenting consumption activity by the 1.3 million households that comprise the top 1 percent to avoid pulling the national saving rate up as they pocketed this vastly increased share of total income.

Some have argued that the savings of the rich were more than offset by middle-income households that increased their debt by taking on ever larger mortgages. In other words, dissaving by the bottom 90 percent of households was sufficient to counter the increased saving by the top 1 percent. But that is not the case. The very rich increased their saving in multiples of millions of dollars, while people in the bottom 90 percent, constrained by credit markets, were only able to increase their indebtedness by the thousands in any given year. Banks and other financial companies will not lend very much without collateral, so the amount that the bottom 90 percent can dissave is restricted to the average growth in housing prices.

Economists Atif Mian, Ludwig Straub, and Amir Sufi have confirmed these trends in their 2021 working paper, “The Saving Glut of the Rich.” Mian and his colleagues show that as the top 1 percent in the United States increased their share of income, they also increased their saving. At the same time, investment in the U.S. economy, both private and public, fell. The U.S. rich followed the same pattern as the rich in other countries, accumulating ever increasing quantities of financial assets. Some of these assets were the mortgages taken out by the bottom 90 percent; after 2008, the top 1 percent acquired large quantities of U.S. government debt.

Mian and co-authors estimate that the top 1 percent save roughly two-thirds of their income; this would equal about 12 percent of all household income in 2018. Even in the period from 1998 to 2007, when dissaving by the bottom 90 percent was at its peak, the increased saving of the top 10 percent of households overwhelmed the increased borrowing of everyone else.

Why are the figures found by Mian and his colleagues so different from the government’s data? This is where corporate greed enters the story. For many decades, it was illegal for corporations to buy back their own shares; it was seen as a form of market manipulation. This changed in 1982 under Reagan’s Securities and Exchange Commission. The SEC’s legal ruling coincided with the movement to align the interests of corporate managers with those of shareholders by significantly increasing the role of stock options and stock grants in compensation packages. The theory was that if managers were also large shareholders, they would act in the interest of shareholders.

Repurchasing shares is a shortcut to raise a firm’s stock price, since buybacks increase earnings per share. So corporations that used to return money to shareholders through dividends have increasingly resorted to buybacks. In most recent years, these repurchases are on the order of half a trillion dollars or more annually. This maneuver helps to assure that the stock options and stock grants provided to top executives will be lucrative even if the firm’s performance is otherwise only mediocre.

The problem is that government accounts treat dividends and share buybacks differently. Dividends distributed by firms are counted as a component of personal income, while share repurchases are a balance sheet transaction that has no impact on household income. This is obviously misleading, since both dividends and buybacks transfer funds from the corporate sector to the household sector. That means the government is understating personal income, and consequently personal saving, by a considerable amount. The difference between the official data and data that adds share repurchases to both personal income and personal saving can be seen in the chart on page 44. The trend lines are similar, but the adjusted saving rate does not fall as dramatically as the official data in the years leading up to the 2008 financial crisis.

The U.S. Trade Deficit

Over the last decade, the United States has been running a chronic balance of trade deficit, reported in the government data as fluctuating between $446 billion and $576 billion per year. The size of the deficit is an ongoing concern for two reasons. First, it suggests the declining international competitiveness of U.S. industry. Second, it points to the need to import capital from abroad to finance this deficit. But there are reasons to believe that the magnitude of this deficit is greatly exaggerated by the tax avoidance strategies of U.S. multinational corporations. The United States has had a relatively high tax rate on corporate profits, so U.S.-based firms have a strong incentive to credit as much of their overseas profits as possible to subsidiaries in places with low rates of taxation on corporate profits. One recent study suggests that fully 40 percent of U.S. overseas profits are booked in these tax havens.

One indicator of this distortion is the contrast between the reported profits per employee in these tax havens with the same ratio for U.S.-based firms. In Ireland, pretax corporate profits for subsidiaries of U.S. firms in 2015 were $8 for each dollar of wages. In the United States, pretax profits were less than 40 cents for each dollar of wages. In other words, most of the value was added in the United States, but the profits were reported by the subsidiaries in tax havens with much smaller workforces.

This misattribution of profits relies on several different mechanisms. Firms such as Microsoft, Amazon, Facebook, and Alphabet (Google’s parent company) that sell advertisements or downloadable content around the world are able to attribute all of their foreign sales to subsidiaries in tax havens. Since much of the work of creating the content or building the platforms was done in the United States, many billions of dollars of sales that would ordinarily be treated as U.S. exports are instead counted as exports from tax havens. In 2018, foreign revenue of these four firms alone was $232 billion.

Firms that make physical products such as iPhones or pharmaceuticals often move both production and the ownership of intellectual property offshore. The work of developing a new smartphone or a new drug is done in the United States, and then the company transfers the ownership of the intellectual property to a subsidiary in a tax haven at a bargain price and organizes production in China or another low-wage location. When the product is shipped into the United States, it counts entirely as an imported product even though much of its value was initially created stateside. As economist Brad W. Setser has shown, the U.S. pharmaceutical trade deficit runs $80 billion a year even though many of the drugs were developed in the United States. If the industry relied on domestic production, imports would be cut by $80 billion a year, and exports would also rise significantly.

Apple, which had global revenues of $265.6 billion in 2018, also employs these strategies to minimize its U.S. tax bill. Economist Yuqing Xing has shown that in the trade data, each iPhone X that is imported into the United States from China adds $332.75 to the U.S. trade deficit, but if one does the same analysis in terms of value added, the deficit would only be $104 per phone. Moreover, the trade accounts ignore most of the value added by U.S. employees for iPhones sold outside of the United States.

Firms also manipulate the prices at which inputs are transferred between subsidiaries. A U.S. firm might export parts to an overseas subsidiary for assembly at an artificially low price and then import the finished product to the United States at an artificially high price. This maneuver assures that the profits can be booked in a lower-tax foreign jurisdiction, but the maneuver artificially inflates the value of imports and reduces the value of exports. Estimating the scale of this distortion is extraordinarily difficult because the mispriced items tend not to be standardized goods but the highly differentiated products of a particular firm.

Taken together, these distortions are probably not enough to eliminate the U.S. trade deficit completely. However, if the data accurately reflected the value added in the United States, the trade deficit in goods and services would be far smaller than what is currently reported. The tax-minimizing strategies of U.S. firms have created deeply misleading data.

U.S. Overseas Assets

Rich people around the world hide vast fortunes in offshore tax havens. The recent leak of data from the U.S. Treasury’s Financial Crimes Enforcement Network documents the enormous scale of these illicit transactions. The leak included many Suspicious Activity Reports (SARs) filed by banks. However, the SARs seem to be a bureaucratic exercise; the banks go right ahead with the questionable transfers anyway. It is unusual for the Treasury to follow up on SARs, except in the rare instance where a transaction is linked to the pursuit of international terrorists.

Those hidden funds do not actually sit in the Cayman Islands or Switzerland; instead, accounts in offshore havens are used to hide the ownership of assets, including stocks and bonds issued in global financial centers as well as holdings in hedge funds and private equity funds. Gabriel Zucman, the most meticulous tax haven researcher, suggests that in 2014, the total holdings in such accounts were $7.6 trillion—or about 8 percent of global financial wealth.

These tax havens make a mess of government statistics. Look, for example, at what happens when a U.S. taxpayer uses a dummy corporation to hide the transfer of $100 million to an account in the Cayman Islands that then purchases stocks and bonds on Wall Street. While the outflow of funds is probably not detected in government data, the purchase of assets might well be recorded as an inflow of foreign capital into the United States.

Zucman estimated that in 2014, 4 percent of U.S. household wealth was held in overseas tax havens. Applying this ratio to Federal Reserve data suggests such holdings rose from $2.9 trillion in 2014 to $3.8 trillion in 2019. The flow of new money plus earnings on existing accounts comes to about $180 billion per year. These transactions are not reflected in the balance of payments data.

These three distortions in the data are connected, because economists have a bad habit of making causal arguments rooted in accounting identities. In national income accounting, national saving (household, business, and governmental) has to equal national investment plus or minus the export or import of capital. But the accounting identity is only true if all of these variables are being measured accurately in the official data. This is a heroic assumption in an era of corporate greed and huge illicit capital flows.

Relying on this flawed data, most economists have not questioned government data that showed a decline of household saving and net U.S. capital imports of half a trillion dollars a year. They have reasoned incorrectly that the United States has had to import capital from abroad because of the shortfall of domestic saving. They could not see the pattern that Mian and his colleagues have uncovered of a domestic saving glut.

A comparable error is made in Trade Wars Are Class Wars, an important new book by Matthew C. Klein and Michael Pettis. They argue that the growing tensions around global trade are caused by distributional struggles within nations; China and Germany are contributing to a global saving glut because their workers have been losing the class war. Low or slowly rising wages have made the rich much richer in these countries, and because domestic saving significantly exceeded domestic investment, both nations have had to export capital.

Klein and Pettis let the United States off the hook. They also assume that if it is importing capital, it could not possibly be contributing to the global saving glut. But the growing maldistribution of income is a global phenomenon that occurs in countries with balance of trade surpluses as well as those with balance of trade deficits. Whether in Russia, China, Germany, the United States, the Middle East, Africa, or Latin America, oligarchs are getting richer and shifting funds into tax havens that allow them to hide their financial assets. The trillions of dollars in assets of the superrich move around the globe, sometimes with just a few keystrokes, making a mockery of balance of payments statistics.

The resulting buildup of financial assets coincides with a decline in rates of productive investment in the United States and abroad. This occurs for at least three reasons. First, businesses are reluctant to make investments in new capacity when consumer demand is weak due to so much income being captured by the very wealthy. Second, the ideology of austerity—temporarily lifted during the global COVID-19 crisis—has caused governments to restrain their spending on critically needed infrastructure because they are under continuous pressure to keep taxes down and avoid deficit spending. Third, highly mobile financial assets intensify the pressures on global corporations to maximize their returns to shareholders. Firms that are seen as putting too much money into uncertain long-term investments are likely to be punished with lower stock prices.

Increased saving and stagnating investment levels fueled the financialization process that led to the global financial crisis. Before 2008, Wall Street firms responded to the saving glut by creating new financial assets to meet global demand for seemingly safe investments that paid a reasonable rate of return. One way they did this was by packaging mortgages into collateralized mortgage obligations (CMOs). When the supply of high-quality mortgages stopped growing, Wall Street firms shifted to packaging subprime mortgages. They used financial engineering and pressure on credit rating agencies to win AAA ratings for some portion of these bonds. When U.S. housing prices fell, these CMOs became toxic sludge on the balance sheets of global financial institutions. Banks drastically cut back lending, and the global economy went into free fall.

A comparable crisis was narrowly averted in 2020 when the pandemic shook global financial markets. At one point, it appeared that a number of hedge funds were at risk of going under. These funds, which now have assets in excess of $2.5 trillion, are permitted to engage in riskier transactions because their investors are supposed to be able to absorb potential losses. A preferred strategy is to make highly leveraged bets on small shifts in interest rates; the hedge funds borrow through repurchase agreements on government bonds (on what’s known as the repo market), a mechanism that allows a virtually unlimited expansion of credit. In mid-March of 2020, highly volatile markets were moving in the wrong direction, and hedge funds faced huge losses. If a number of these larger funds had been forced into bankruptcy, the impact might have been similar to the collapse of Lehman Brothers in 2008: a financial domino effect that threatens the global economy. To avoid this, the Federal Reserve began an emergency program of buying up government bonds.

The reason that hedge funds have such massive assets, and thereby pose such a great risk to the global economic system, is directly related to the saving glut of the wealthy. That glut greatly increases the fragility of the global economy by fueling dangerous speculation. It’s a vicious cycle: the saving glut drives financialization, which further increases income inequality, generating a greater saving glut. Governments and central banks have built in the expectation that they will have to intervene periodically to rescue the financial highfliers.

It is difficult to imagine a more scathing indictment of the current organization of the global economy. Consumption levels for working people are artificially restrained, the rich get richer, and the financial system gets more fragile. The obvious solution is to increase income and wealth taxes and to shut down the tax havens. With increased tax revenues, governments could finance substantially higher levels of investment in education, health, infrastructure, clean energy, and the resilience of communities threatened by climate change. This could be done both through direct government outlays and by governments underwriting loan programs that finance vitally needed investment. The richer nations could also significantly increase grants and low-interest loans to finance similar efforts in the world’s poorer nations.

As we try to envision a world on the other side of the COVID-19 pandemic, it is essential that we challenge the power and wealth of the twenty-first-century robber barons. Their investment savvy, entrepreneurial energy, and philanthropy are not making the world better. On the contrary, their existence produces injustice, economic instability, environmental degradation, and authoritarianism. We can and should aspire to a world without billionaires.

Fred Block is Research Professor of Sociology at the University of California at Davis and president of the Center for Engaged Scholarship. His most recent book is Capitalism: The Future of an Illusion.