Crisis Cranks

Crisis Cranks

Economists Posner and Weyl’s book Radical Markets attempts to make sense of the current moment and propose a way out, but their unorthodox proposals come up short.

Radical Markets: Uprooting Capitalism and Democracy for a Just Society

by Eric A. Posner and E. Glen Weyl

Princeton University Press, 2018, 352 pp.

“A sure sign of a crisis is the prevalence of cranks. . . . The cranks are to be preferred to the orthodox because they see that there is a problem.”

– Joan Robinson, 1972

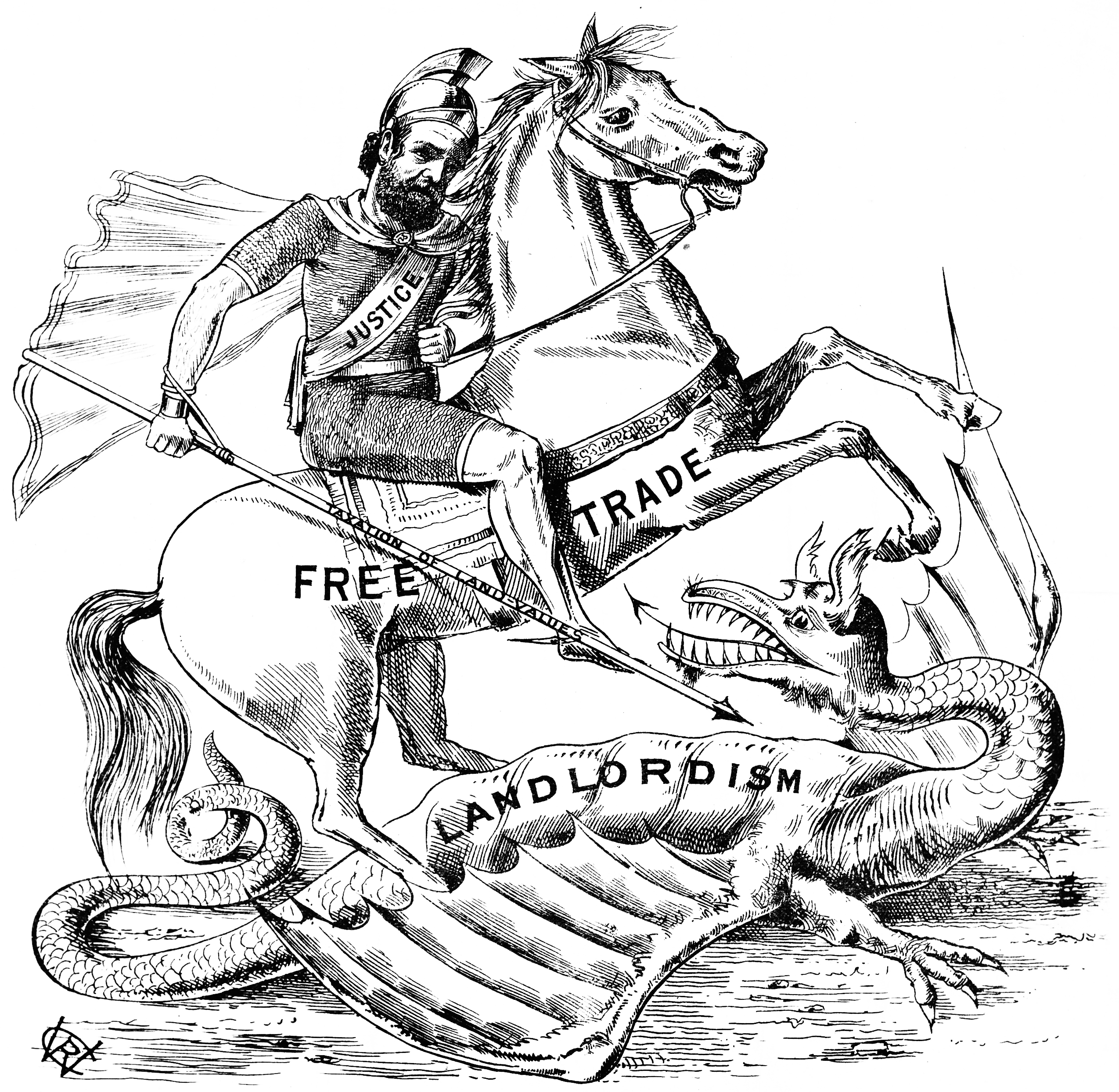

Henry George couldn’t believe how high the rents were around San Francisco. In the hills outside Oakland one day in 1870, the journalist heard from a teamster that empty land nearby was selling for a thousand dollars an acre. “Like a flash,” George recalled, he realized that the source of Gilded Age inequality lay in the landlord’s arbitrary monopoly over a resource that nature had fixed in quantity. Like a parasite, an owner of real estate could extract wealth by charging productive laborers for the use of a resource that he had done nothing to create. George proposed a solution as well: the “single tax,” a levy that would strip from landlords the value of their unimproved land (“improvements” to the land, such as apartment buildings or sugar mills, would not be so taxed). The idea caught fire, engendering Single Tax clubs, utopian colonies, and the board game Monopoly, as well as George’s nearly successful 1886 run for mayor of New York City.

In its day, George’s treatise Progress and Poverty was more popular than any book besides the Bible and Uncle Tom’s Cabin. Though he is little remembered (much less read) today, you can trace the subterranean influence of his ideas into the present. Harold Hotelling, born in 1895, gave a presidential lecture to the Econometric Society in 1937 that mixed cutting-edge statistical analysis with a suggestion that the landless classes should confiscate rentier wealth. One of Hotelling’s students, William S. Vickrey, died en route to a Georgist conference that he had helped to found, just days after he had won the 1996 Nobel Prize in Economics. And now Eric Posner and Glen Weyl, a law professor and an economist respectively, have published Radical Markets, a book dedicated to the memory of Vickrey.

Posner and Weyl’s book appeared last spring, as Facebook reeled from the Cambridge Analytica scandal, Donald Trump extended his tariffs on foreign steel and aluminum, and the New York Times discovered something called “antitrust hipsters.” The months since have only made it clearer that the basic rules of political economy are now up for grabs. The president ignores economic experts while unemployment sinks to levels economists recently thought impossible; on paper the economy continues a decade-long expansion even as ideas about secular stagnation and financial instability become ever more widely discussed. Impulses once thought defunct, including democratic socialism and the anti-monopoly movement, have reemerged—most clearly in the discourse of powerless intellectuals but also in selected policy circles and electoral platforms.

With its devotion to lost causes (Georgism) and its impatience with piecemeal reform, Radical Markets shares certain features with the recent left-wing resurgence—an intriguing convergence, given that Posner (a professor at the University of Chicago law school) and Weyl (who has taught in Chicago’s economics department) have ties to the libertarian movement that did so much to define the common sense of pre-2008 American politics. The care that they take to distinguish themselves (as “market radicals”) from forebears like Milton Friedman and George Stigler (“market fundamentalists”) is evidence of ferment within neoliberalism itself. The range of endorsements the book has received—from libertarians like Peter Boettke and Bryan Caplan to liberals like Martha Nussbaum and even Catholic anarchist Nathan Schneider—constitutes at least prima facie evidence that a new politics of markets can scramble the divide between right and left, yielding unfamiliar ideas capable of attracting diverse adherents.

Radical Markets consists of a diagnosis of “the crisis of the liberal order,” followed by five proposed solutions. Given the tenor of most recent hand-wringing about liberalism in extremis, it is refreshing that Weyl and Posner frame their “crisis” in clear political-economic terms. The Reagan-Thatcher revolution promised that relaxing institutional constraints on inequality would unleash economic growth. In the real world, Weyl and Posner note, “We got the inequality, but dynamism is actually declining.” Drawing a parallel with the stagflation (rising prices during recession) of the 1970s, they label our current malady “stagnequality.” Just as regnant Keynesians supposedly struggled to explain the anomaly of rising prices during recession, today’s neoliberals struggle to explain anemic growth rates alongside gross inequalities. I can’t imagine this term will stick (the word itself suggests “equality” as much as “inequality”), but few will question that it points to a decisive problem of our time.

The book’s five solutions to “stagnequality” vary greatly in their scope and ambition, but as “radical market” ideas they all propose attacking the inequalities attendant to capitalism by extending, rather than constraining, the reach of market forces. This recalls Henry George, who thought that capital income (unlike rent) was legitimate, as well as Adam Smith, who condemned state-backed monopolies on behalf of consumers, laborers, and small tradesmen alike. Unlike these predecessors, Weyl and Posner are willing to suggest that, in the name of markets, capitalism itself might need to be dispensed with.

The most dramatic proposal—literally, Weyl and Posner’s single tax—is the common ownership self-assessed tax (COST). Briefly, in this system people would assign values to their assets. They would pay some percentage of the self-assessed value as a tax. But anyone else can buy the asset for its declared value. If you really wish to hold on to something, you will place a high value (and pay a high tax) on it. If you lowball your estimates to trim your tax bill, or just because you don’t actually value an asset all that much, anyone else can instantly (or quickly—there is some equivocation here) buy the asset away from you at a price determined by your initial self-assessment.

At first blush, this world of forced sales and ceaseless auctions will strike many as dystopian. But, especially if you think of the classic Georgist example of real estate, you can also see how weakening incumbent claims could, in some cases, be all to the good. Reading this chapter, I was reminded of Guatemalan history: when the reformist Jacobo Árbenz nationalized vast tracts of idle land belonging to the United Fruit Company, he offered compensation in line with the (scandalously low) value that United Fruit itself had placed on the land on their tax returns. Of course, Árbenz was swiftly overthrown by the CIA, which raises questions about the ultimate roots of property rights in violent coercion, a topic which is (perhaps needless to say) as absent from Radical Markets as it is from so much other libertarian thought.

The most vexing problem with COST is the question of initial endowments. If people started out with the same amount of money, you can imagine how the omni-auction regime might make the world better, or at least more efficient. As long as people have very different amounts of money, however, the prospect of expanding the realm of money claims to include the forced sale of every piece of property to anyone who can pay a penny more than its assessed value is terrifying. Weyl and Posner’s answer is to redistribute the receipts of the COST to the population in the form of a progressive “social dividend.” Still, the ensuing leveling would not be especially dramatic: they say that a family with $14 million in wealth would pay $280,000 annually. What’s more, they propose using the proceeds of COST “to eliminate all existing taxes on capital, corporations, property, and inheritance,” a move that would have even more dramatically regressive consequences.

That the COST would leave in place basically the entire structure of inherited wealth inequality (in other words, the class structure) makes it even odder that Weyl and Posner flirt with labeling it a transcendence of capitalism. Recall that the first two letters in the acronym stand for “common ownership.” In some sense, the COST system would mean that no one owns anything, they only temporarily rent it from society. This could, Weyl and Posner write, “change our relationship to property” and encourage us to invest time in experiences and personal relationships rather than things. Through some vague process of free association, they even associate this new order of things with the insights of Buddhism (though, since they are economists, they speak of “optimal Buddhism.”) And yet all this is to happen in a world in which, even if we accept Weyl and Posner’s optimistic forecasts, the level of inequality would be roughly halfway between the plutocracy of the 2010s and “the low points in the 1970s.” It is worth remembering that the 1960s and 1970s, which were more equal than the situation Weyl and Posner imagine, were still acquisitive and unequal enough that when Americans started talking about Buddhism it was as part of the counterculture.

Another proposal in Radical Markets, the Visas Between Individuals Program, would allow people in wealthy countries to “sponsor” immigrants from poor countries. These new entrants into the labor force would not be covered by minimum wage laws (or else, Weyl and Posner reason, there would be no incentive to “sponsor” them). Somewhat oddly, they answer the charge that this system is “uncomfortably close to indentured servitude” by pointing out that “we already have a subordinate class of low-wage workers,” namely “illegal [sic] aliens.” But merely proposing to extend an already existing institution of status inequality hardly seems radical, much less worthy of a chapter titled “Uniting the World’s Workers.” In place of the emancipatory vision of their Enlightenment forebears, Weyl and Posner counsel despair: “natural human instincts toward tribalism” make even a formally egalitarian solution to global inequality impossible. Their call for strict law enforcement to ensure that migrants do not defect from their “sponsors,” along with the Orwellian acronym “VIP,” does not make the proposal feel any less chillily inhuman.

Two more proposals, also concerning economics, are less detailed and less potentially transformative. One suggests that social media users receive micropayments to compensate them for the value they produce as generators of data (a familiar idea from Jaron Lanier’s 2013 book Who Owns the Future? as well various farther left demands for “wages for Facebook.”) Another measure would reduce monopolistic market power by prohibiting institutional investors (which together control around a quarter of the U.S. stock market) from owning shares of competitors within the same industry. Both of these proposals seem . . . fine. Hardly revolutionary, but I would not complain if they were to show up in a party platform or a presidential debate.

In addition to these four essentially economic proposals, Radical Markets also presents a political reform called “quadratic voting” (QV). In this system, a single voter can allocate more than one vote to a candidate or referendum, based on the intensity of their preferences. Their account of how it would improve the human lot is far from convincing. Don’t we already have a voting system that rewards preference intensity (most people don’t vote, so if you really care about something and turn out to vote, or pay people to tell other people how to vote, you already have disproportionate power to shape outcomes)? Posner and Weyl don’t just see QV as a procedural improvement but as a system-transforming measure that is qualitatively similar to the transition from absolutism to democracy. Extrapolating wildly from empirical studies that allegedly show that “the introduction of democracy to a country on average causes a 20% increase in national income,” they claim that “while there is no reason to expect QV to bring precisely” the same gains, it still “seems a reasonable benchmark.”

The QV dream—that the “public goods that we all share can be provided as efficiently and smoothly as the market provides us smartphones and mattresses”—is symptomatic of their fundamental rejection of politics. They want to see voluntary interactions among individuals completely replace practices of collective self-governance in which the citizen—not the consumer—is sovereign.

This rejection of politics reaches its climax in a bizarre but fascinating coda. For Weyl and Posner, the economy is essentially a question of information processing. Before capitalism, the relevant information was simple enough that people could do the calculations themselves. Today, the global economy presents far more information than we can process through conscious deliberation. Even computers available in 2018 can’t do the relevant math, so we still need market signals to coordinate economic decisions. But Weyl and Posner confidently predict that within a few decades (“probably the 2050s”) the “total capacity of digital computers will exceed that of all human minds.” At this point, computers will be able to do the planning and markets will recede into the past.

If this all sounds esoteric, it is worth emphasizing how far this argument puts Weyl and Posner from the mainstream of the economics profession. For decades, economists from Friedrich Hayek to Joseph Stiglitz have agreed that there is something ineffable, and certainly unquantifiable, in the kind of knowledge that pertains to economic decision-making. Though for Hayek this viewpoint had a right-wing valence, there is also a left-wing rendition of the claim that social life cannot be reduced to an objective function. Weyl and Posner, nearly alone among contemporary economists, embrace a much older idea, which they explicitly credit to the twentieth-century Polish socialist Oskar Lange: the only thing keeping us from transcending markets is the limitation of the forces of production. Once Moore’s Law runs its course, everything that once seemed irreducibly human will become a computing problem.

There is something here for leftists to think about. If they revolt at Weyl and Posner’s view of the world, does this mean they share Hayek’s counsel of despair about the possibilities of planning? If not, what stops them from joining Weyl and Posner in hoping the real world will soon converge on the neoclassical model? And in that world, what would it mean to be on the right—or the left?

In the short term, a different question suggests itself. Is there any chance these proposals could be enacted any time soon? For now, the answer is clearly no. Even the most modest proposal (anti-trust regulations for institutional investors) would represent a challenge to corporate power that has not been seen from either political party in years. Changing that would require the kind of political education and interest-group mobilization that could take years, even if we lived in a minimally functional democracy. The more ambitious proposals would require a profound shift in U.S. public opinion (which currently views secure property ownership with favor and holds indentured servitude in at least mild disrepute)—not to mention the creation of vast new transnational institutions of governance and enforcement.

In defense of their utopianism, Weyl and Posner cite Keynes’s famous justification of his own project: “The ideas of economists . . . are more powerful than is commonly understood. Indeed the world is ruled by little else.” But the actual history of Keynesianism demands a mixed verdict. The magnitude of the Great Depression provoked “Keynesian” policies from people who had not and could not have gotten them from Keynes, and ultimately it was the global war against fascism that ended the slump and vindicated the new economics. Even if you take a generous view of the political power of economic ideas, it is clear these ideas need to be carried along by groups of people with an interest in transforming society and the capacity to do so. Sometimes this means that it takes unspeakable violence to accomplish the most rational measures—what historical sociologist Barrington Moore called “the contributions of violence to gradualism.”

Take Henry George. He stated, “We have no fear of capital, regarding it as the natural handmaiden of labor; we look on interest in itself as natural and just; we would set no limit to accumulation, nor impose on the rich any burden that is not equally placed on the poor.” But his campaign for mayor of New York—in which he beat Republican Theodore Roosevelt and threatened to defeat the Democratic iron tycoon Abram Hewitt—was carried by the headwinds of conflict between social groups. He was the candidate of the United Labor Party; the year was 1886, when industrial violence threatened to turn into civil insurrection. George also drew massive support from the landless Irish and their relatives on both sides of the Atlantic, who were in the middle of sustained anticolonial agitation that would within twenty years help to fracture the British empire.

If this is the empirical record, it is far from obvious how to feel about it. Recognizing the role of force in history should not lead anyone but a sadist to welcome catastrophe for the opportunity it brings. What’s more, socialists believe that their political program has a universal and rational core, that it could lead in some way to the uncoerced harmony of interests that libertarians find in the marketplace. In that sense, leftists—as much as technocrats and growth fetishists—yearn for a tide to lift all boats.

In the world in which we actually live, a rising tide is more likely to drown millions. On this aspect of our future—climate change, the market failure that could end all markets—Radical Markets has nothing to say. The book is also stunningly silent on healthcare and education, which together claim nearly a quarter of our national income, and which growing numbers of people want to see fully decommodified, and on the racial wealth gap that defines American inequality and inflects every conversation we have about political economy. Outside the recasting of Facebook use as labor, and the call for strict enforcement of immigration laws, there is nothing on the economic life of people at work. There is almost nothing on the classic macroeconomic questions of investment, price stability, and aggregate demand. I could not tell you exactly how a viable and hopeful social movement could emerge from this mess of issues; I doubt Weyl and Posner could either. But these areas where the book is silent, which bring together interests and ideas, and which point to antagonisms within society, are the fractures along which new majorities will be composed. The future promises the return of politics, along with all its nasty fights over who gets what. It’s still up to us whether it might also promise something more.

Tim Barker is a graduate student in American history at Harvard and an editor at large for Dissent.