Ferguson Digs In Its Heels

Ferguson Digs In Its Heels

The city of Ferguson has reneged on its promises to reform policing practices. Its current standoff with the Justice Department reveals the stubbornness of a municipal system that combines handouts to big corporations with predatory fines for the poor.

Nineteen months have passed since the death of Michael Brown, and less than a year since the release of the Justice Department’s scathing examination of predatory racism in the Ferguson Police Department. The problem—amply documented by Justice, as well as local groups Arch City Defenders and Better Together St. Louis—was not just the starkly disproportionate impact of local courts on African Americans, but the ways in which Ferguson and other St. Louis County municipalities relied on fines and forfeitures as a source of revenue. “The residents of Ferguson do not have a police problem,” as Ta-Nehisi Coates summed it up last year, “They have a gang problem. That the gang operates under legal sanction makes no difference. It is a gang nonetheless, and there is no other word to describe an armed band of collection agents.”

The political response was slow but meaningful. Missouri Senate Bill 5, signed by Governor Nixon in July, introduced a spate of reforms, including a cap on court fines as a share of municipal revenues. Negotiations between Ferguson and the Justice Department proceeded fitfully, slowed by the city’s fiscal anxieties (“We feel that what they are asking would financially ruin the city,” as one city councilor complained just before the anniversary of Brown’s death). In January, Ferguson officials finally agreed to a settlement that would bolster community policing and meet the modest expectation that municipal code enforcement be animated by a concern for public safety rather than the city’s budget.

Last week, that deal crumbled. To the palpable dismay of community members in attendance, the Ferguson city council amended the consent decree, most notably pulling back on commitments to raise police salaries and asserting that the terms of the deal would not apply to outside agencies if the city decided to contract out policing or collections. The Justice Department wasted no time filing suit, citing the city’s “routine violation of constitutional and statutory rights, based in part on prioritizing the misuse of law enforcement authority as a means to generate municipal revenue over legitimate law enforcement purposes,” and the unlikelihood that “that the City will remedy these patterns and practices of unlawful conduct absent judicial mandate.”

It is a distressing turn of events. Ferguson’s petulant retreat is certainly animated in part by uneven citizenship that prevails in North St. Louis County, by which local authorities (as the Justice report concluded) “see some residents, especially those who live in Ferguson’s predominantly African-American neighborhoods, less as constituents to be protected than as potential offenders.” But it is also animated by mundane budgetary anxieties, by a fiscal desperation that pressed the Ferguson police—under clear and unambiguous direction from city officials—to also see those offenders as “sources of revenue.” How did it come to this?

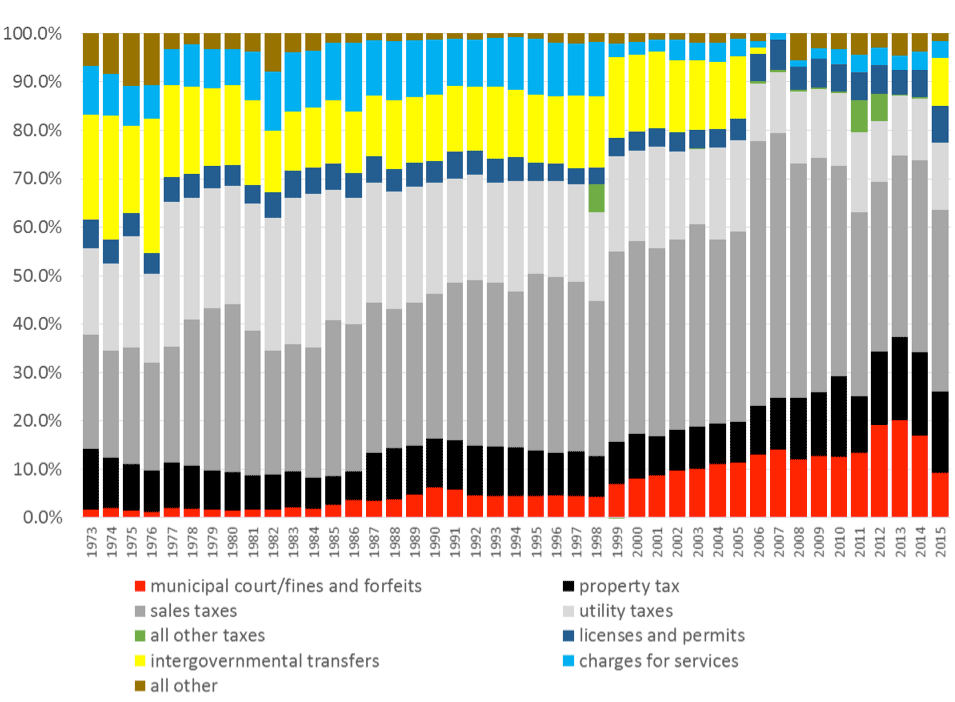

Ferguson’s fiscal troubles were a long time in the making. The city’s property tax base has always been meager—since 1973, contributing only an average of 10 percent to general fund revenues (see Figure 1, based on the city’s Combined Annual Financial Reports for 1973–2015). Property tax revenues were dampened by Missouri’s 1980 Hancock Amendment, which curtailed the ability of local governments to raise rates and dampened assessed values. Since 1985, local residential property has been assessed at less than one-fifth of its actual value. The city has also been quick to forgo revenues on commercial property. Some of the largest commercial ratepayers, including Walmart and Home Depot, sit in tax-increment financing (TIF) districts. Under this scheme, growth in property tax revenues (and, in the case of the most recent TIF district, increased sales taxes too) is siphoned off to pay back the bonds used to finance the big-box outlets’ construction. Others, like the Fortune 500 company Emerson Electric, rely on artificially low assessments. In 2011 alone, a successful appeal by Ferguson to rollback the assessed value of the company’s Ferguson campus cost the city $50,000 in foregone property tax revenue.

Calculated from Combined Annual Financial Reports.

The largest contributor to Ferguson’s general fund, averaging over a third of revenues since 1973, is the sales tax. Here Ferguson, like other struggling inner suburbs, is beholden to the peculiarities of Missouri’s sales tax system, which allows municipalities to hoard their share of local taxes as a “point of sale” city, or to put their share into a statewide pool and divide up the total. For the past forty years, Ferguson officials have opted in and out of the state pool, hoping that new commercial development (paid for largely by giving up on property tax revenues) would bolster the bottom line. The problem was that all the neighboring municipalities were doing the same thing—yielding an intensely competitive scramble for the next mall, the newest big-box retail development. City officials attributed a dip in sales tax revenues in the early 1990s “in part to the opening of more outlets in the St. Louis area by one of our major businesses, which tends to draw customers to the new locations.” Translation: we provided huge subsidies to Walmart, and then Walmart went and built another store two miles away with huge subsides from someone else.

The next most important source of revenue, at least into the early 2000s, was transfers from other levels of government. But these were fickle. Federal revenue-sharing gradually dried up, and state transfers (the city’s share of gas, road, vehicle, and cigarette taxes) were both unreliable and constrained (gas tax receipts, for example, could only be used for street repairs). And, as Ferguson’s population began to decline, these transfers (calculated on a per capita basis) declined as well. And, of course, the whole revenue structure—resting largely on a tangle of sales taxes and user fees—was starkly regressive.

This is the context—declining revenues, rising costs, and systematic abatements for those most able to pay—in which the municipal courts became so important. Fines and forfeitures passed the property tax as a source of general fund revenues in 2001, and made up fully 20 percent of those revenues by 2013. In 2006, as intergovernmental transfers withered, Ferguson officials noted approvingly that “[p]olicing efforts have contributed $313,138 in additional revenue over 2005-6 budget figures . . . due to increased efforts of the Police Department.” In 2013, the Ferguson Municipal Court processed almost 25,000 warrants and over 12,000 court cases—a rate of 3 warrants and 1.5 cases for each household in its borders.

The death of Michael Brown, and the Justice investigation which followed, threw a spotlight on these practices—which were (and are) pervasive across North St. Louis County. Local, state, and federal efforts had made some progress in the last nineteen months, but that ground to a halt last week. Ferguson officials offer no perverse Orval-Faubus-at-the-schoolhouse-door defense of their actions, and indeed have conceded to most of the charges laid out by local activists and by the Justice Department. It is a pathetic irony, I suppose, that they are not disputing the violation—they just claim not to be able to pay the fine.

Colin Gordon is a professor of history at the University of Iowa. He is the author of Mapping Decline: St. Louis and the Fate of the American City (2008) and a companion website.