The Legacy of the Clinton Bubble

The Legacy of the Clinton Bubble

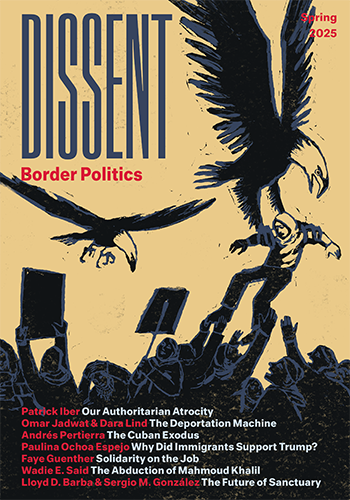

Bill Clinton after signing the Financial Services Modernization Act in 1999. Photo: Justin Lane/The New York Times/Redux

The conventional wisdom has held that economic policy was a great success under Bill Clinton in the 1990s and a failure ever since. Hillary Clinton has made the comparison often, promising to end “the seven year detour” and “attack poverty by making the economy work again.” In January, in response to the president’s State of the Union Address, Barack Obama stated that it was “George Bush’s Washington that let the banks and financial institutions run amok and take our economy down this dangerous road.”

Perhaps this reading of history makes for good politics in an election year, and it is certainly better for the Clintons than for anyone else. The only problem is that the story line is flawed. One could even say that it’s a bit of a fairy tale.

For six of eight years, Bill Clinton governed with Republican majorities in Congress. Not surprisingly, there was much continuity between the Clinton and Bush administrations. Both embraced the so-called Washington Consensus, a policy agenda of fiscal austerity, central-bank autonomy, deregulated markets, liberalized capital flows, free trade, and privatization.

On each of these crucial issues, the most significant differences between Clinton and Bush were differences in timing and degree, not in direction. Both administrations were willfully asleep at the wheel. Clinton was fortunate to preside over the early stages of a bubble economy. Bush has had the misfortune of presiding as a lame duck through the final stages of the same bubble and, thanks to the deregulation of the Clinton years, without a regulatory structure capable of containing today’s speculative fevers.

In 1992, Bill Clinton campaigned on the promise of a short-term stimulus package. But soon after being elected, he met privately with Alan Greenspan, chair of the Federal Reserve Board, and soon accepted what became known as “the financial markets strategy.” It was a strategy of placating financial markets. The stimulus package was sacrificed, taxes were raised, spending was cut—all in a futile effort to keep long-term interest rates from rising, and all of which helped the Democrats lose their majority in the House. In fact, the defeat of the stimulus package set off a sharp decline in Clinton’s public approval ratings from which his presidency would never recover.

It is easy to forget that Clinton had other alternatives. In 1993, Democrats in Congress were attempting to rein in the Federal Reserve by making it more accountable and transparent. Those efforts were led by the chair of the House Banking Committee, the late Henry B. Gonzalez, who warned that the Fed was creating a giant casino economy, a house of cards, a “monstrous bubble.” But such calls for regulation and transparency fell on deaf ears in the Clinton White House and Treasury.

The pattern was set early. The Federal Reserve became increasingly independent of elected branches and more captive of private financial interests. This was seen as “sound economics” and necessary to keep inflation low. Yet the Federal Reserve’s autonomy left it a captive of a financial constituency it could no longer control or regulate. Instead, the Fed would rely on one very blunt policy instrument, its authority to set short-term interest rates. As a result of such an active monetary policy, the nation’s fiscal policy was constrained, public investment declined, critical infrastructure needs were ignored. Moreover, the Fed’s stop-and-go interest-rate policy encouraged the growth of a bubble economy in housing, credit, and currency markets.

Perhaps the biggest of these bubbles was the inflated U.S. dollar, one of several troubling consequences of the Clinton administration’s free-trade policies. Although Clinton spoke from the left on trade issues, he governed from the right and ignored the need for any minimum floor on labor, human rights, or environmental standards in trade agreements. After pushing the North American Free Trade Agreement (NAFTA) through Congress on the strength of Republican votes, Clinton paved the way for China’s entry into the World Trade Organization (WTO) only a few years after China’s bloody crackdown on pro-democracy demonstrators at Tiananmen Square in Beijing.

During Clinton’s eight years in office, the U.S. current account deficit, the broadest measure of trade competitiveness, increased fivefold, from $84 billion to $415 billion. The trade deficit increased most dramatically at the end of the Clinton years. In 1999, the U.S. merchandise trade deficit surpassed $338 billion, a 53 percent increase from $220 billion in 1998.

In early March 2000, Greenspan warned that the current account deficit could only be financed by “ever-larger portfolio and direct foreign investments in the United States, an outcome that cannot continue without limit.” The needed capital inflows did continue for nearly eight Bush years. But it was inevitable that the inflows would not be sustained and the dollar would drop. Perhaps the singular success of Bill Clinton was to hand the hot potato to another president before the asset price bubble went bust.

Financial Deregulation under Clinton

No one could drive a car well for very long on roads without traffic lights, stop signs, or speed limits. There is an obvious need for sensible regulation, even “command and control” regulation, to facilitate safety and traffic flow. Likewise with most markets, particularly the financial markets, where some degree of regulation is necessary to prevent fraud and provide order, stability, and coherence to private transactions. Yet the Washington Consensus has denied the need for regulation of the financial marketplace at every level. Jagdish Bhagwati, a prominent free-trade economist, has referred to the “Wall Street-Treasury-IMF complex” to suggest a policy agenda formulated and pushed by powerful financial interests. Joseph Stiglitz, the 2001 Nobel laureate in economics, has noted the agenda’s many unscientific assumptions and refers to its promoters as “free market fundamentalists.”

At the very local level of finance—consumer credit and housing loans—the analogue to speed limits and traffic-flow regulation would be limits on loan volumes, interest rates, and minimum down payments. For years the federal government had regulated such lending standards to prevent inflation of asset prices in key sectors of the economy, particularly during wartime and boom times. For instance, Federal Reserve Regulation X required minimum down payments and maximum periods of repayment for housing loans. Federal Reserve Regulation W utilized the same devices for consumer credit for the purchase of automobiles, appliances, and other durable goods.

But starting with the administrations of Jimmy Carter and Ronald Reagan, and continuing under Clinton, such regulations were mostly repealed. Known as “selective credit controls,” these policy instruments took a “command and control” approach to regulation. It was an approach that reduced systematic risk by discouraging the development of a subprime mortgage market for borrowers with bad credit. Without such controls, lenders started making a flood of loans without minimum down-payment requirements, and eventually without even requiring documentation of income on many loans. Adjustable interest rates and hidden balloon payments made these loans inherently more risky.

Predatory lending was not an invention of the Bush administration. High-interest payday loans and subprime mortgages took off under Clinton. The morals of the marketplace were once again, “Buyer beware.” Many loans, tellingly referred to as “teaser loans,” were structured so that the monthly mortgage payments would start off low and rise significantly in the future, even while the overall loan amount—the outstanding principal—would also rise. The borrower would end up worse off several years into the mortgage than when the loan began.

But none of this was considered overly problematic by the Clinton White House. There was simply too much money to be made by lenders, brokers, bankers, bond insurers, ratings agencies, engineers of securitized assets, and managers of special investment vehicles and hedge funds. There was also too much to be gained by elected officials and regulators looking the other way.

By 1995, the subprime loan market had reached $90 billion in loan volume, and it then doubled over the next three years. Rising loan volume led to a significant deterioration in loan quality. Meanwhile, by March 1998, the number of subprime lenders grew from a small handful to more than fifty. Ten of the twenty-five largest subprime lenders were affiliated with federally chartered bank holding companies, but federal bank regulators remained unconcerned.

In 2000, Edward Gramlich, a Federal Reserve governor, proposed to Greenspan that the Fed use its discretionary authority to send bank examiners to the offices of such lenders. But Greenspan was opposed and Gramlich never brought his concerns to the full Federal Reserve Board.

Greenspan’s laissez-faire philosophy also encouraged greater concentration in banking and the proliferation of complex financial instruments known as derivatives. As early as 1997, there were concerns about the growth of collateralized debt obligations (CDOs), derivatives that pooled together millions of subprime mortgages and divided their income streams in complex ways. Rather than reducing risk, the process of securitization served to increase risk throughout the financial system. The CDO and other such derivatives were like rocket fuel, transforming the local greed of subprime lending into a problem of global proportions. Since the recent meltdown in the subprime market, investors have been in a panic to find out which banks and hedge funds are holding CDOs and other exotic mortgage-backed securities that are deflating in value.

As with the housing bubble, so went the stock market bubble. The Federal Reserve has a long history of imposing margin requirements (minimum down payments) on lending for the purchase of securities on major exchanges. Regulations G, T, and U gave the Fed important tools in containing stock-market speculation. But with Clinton in the White House and Robert Rubin as his treasury secretary, Greenspan felt no pressure to raise margin requirements even as the stock market bubble reached new heights. Instead, Clinton reappointed Greenspan as Federal Reserve chair in early 2000, about six months before Greenspan’s term was due to expire, and apparently without first discussing margin requirements or any other Federal Reserve policy with Greenspan.

By Clinton’s final year in office, the price-earnings ratio on technology stocks reached historic peaks and the level of margin debt borrowed from New York Stock Exchange (NYSE) member firms had risen to the highest percent of market value in twenty-five years. The last time the country had purchased so much stock on borrowed money was September 1987, one month before the Dow Jones Industrial Average fell 23 percent in one day.

In March 2000, alarmed by the growing stock market bubble, Richard Grasso, chair of the NYSE, and Frank Zarb, chair of NASDAQ, issued an unusual joint statement urging member brokerage firms to review the amount of credit they were extending to investors and to consider voluntarily raising their margin requirements. The warning fell on deaf ears. In such a bull market, investors were feeling more greed than fear, and therefore underestimating the downside risks in the market.

Meanwhile, Greenspan refused to exercise any authority and failed to raise margin requirements. Instead, he attempted to talk down the market in his widely reported “irrational exuberance” speech. But when the market slid, it was Greenspan who backed down and provided verbal reassurances.

Selective credit controls are like a steering wheel. Margin requirements can steer credit away from speculative and overheated sectors of the economy. When the central bank uses only one blunt policy instrument, the short-term interest rate, it is abandoning the steering wheel for the stop-and-go of an accelerator. As the Fed lowered short-term interest rates, the bubble expanded and asset prices diverged even further from economic fundamentals. When the Fed later raised interest rates to slow the stock market bubble, it ran the risk of puncturing the bubble completely. This is what Greenspan faced while the Fed raised short-term interest rates six times, from 4.75 percent to 6.50 percent, between June 1999 and May 2000. But with each rise in rates, the bubble only expanded—that is, until the dot-com bubble burst in the spring of 2000, a bust that did not help Al Gore’s presidential prospects.

This dilemma was not without historical precedent. Frederick Lewis Allen described a similar tension between monetary policy and market psychology in his review of the 1929 stock market crash in Only Yesterday. Then, too, the Federal Reserve “waited patiently for the speculative fever to cure itself and it had only become more violent.” According to Allen, things had come to such a pass that if the Fed raised interest rates still further, it “ran the risk of bringing about a terrific smash in the market.”

In the past, selective credit controls provided a way around this Catch-22. Margin requirements on security loans, housing loans, and consumer credit provided the federal government with the policy tools to prevent inflation in particular asset markets. Deregulation left the Federal Reserve with only one policy instrument. As the Fed lowered interest rates to stimulate the real economy, the bubble in asset prices expanded. When the Fed later raised interest rates, it posed a mortal danger to every bubble, including those in housing, credit, and currency markets.

Deregulation and lax lending practices were part and parcel of the bubble economy. Clinton often boasted of the rise in homeownership during his presidency, foreshadowing the Bush-Cheney “ownership society.” But for too many, homeownership became something more speculative, a wager that interest rates would not rise in the future, and that if rates did rise, mortgage lenders would allow them to refinance at fixed interest rates based on constantly rising housing prices.

Risk-Based Deregulation

During the Clinton years, command-and-control regulation was largely replaced by a risk-based approach that was based on inherently flawed estimates of value and risk. According to risk-based capital requirements, the greater the risk of a loan, the greater amount of capital a bank would be required to raise. But this risk-based approach made little sense when regulators were using inflated market prices to build their defenses.

Some commentators have concluded that market-price-based, risk-sensitive models are upside down. Booms are fueled by market estimates that wrongly undervalue risks, thereby encouraging imprudent lending. As the boom matures, everyone undervalues risk, and lenders respond by chasing after the marginal borrower. Regulators fail to pull the banks back. Instead, they send the wrong message that risks are falling and capital is sufficient for more risk-taking.

Some banking and finance experts have proposed making bank capital requirements contra-cyclical by relating the capital adequacy requirements to the rate of change of bank lending and asset prices in relevant sectors, such as the rise in mortgage lending and housing prices. This, they claim, would build up capital reserves and restrain bank lending during asset price booms while encouraging bank lending during asset price deflations. A final benefit of this approach would be “to reduce pressure from the financial system for central banks to adjust monetary policy in the heat of the moment”—or, in other words, to reduce the need for the Fed to step on the accelerator in a crisis.

According to Charles Freeland, former deputy secretary general of the Basel Committee on Banking Supervision, there are problems with making capital requirements contra-cyclical because “the cyclical indicators would need to be derived from national markets and it is difficult to see how they could be applicable to a bank operating in a highly competitive global environment.” Moreover, how does one determine the proper cyclical indicator for a particular security held by a financial institution? If tranches of a CDO include parts of mortgage loans pooled from widely varied geographic locations, some from markets where housing is in a boom, others where housing is relatively weaker, it would be impractical to link the required capital reserve to housing prices.

The esoteric debate about capital adequacy requirements only reinforces the simple truth that mortgages and other loans should not be made in the first place to borrowers with limited resources. Although some legal scholars have suggested “suitability” claims against investment banks for selling risky CDOs, these problems began upstream. Underlying mortgage loans with escalating interest rates and balloon payments seem inherently unsuitable when made to borrowers lacking collateral.

There is really no risk-based substitute for the traffic lights and speed limits and other safety standards that keep some cars off the road. At the end of the day, regulators must regulate. Minimum down-payment requirements will keep most of the riskier borrowers off the road. Moreover, with selective credit controls, when bank lending and housing prices escalate too much too quickly in particular regions, bank supervisors could simply clamp down by raising the minimum down payment requirements and restricting the use of adjustable interest rates and balloon payments. Such regulation would mean fewer mortgage loans for marginal borrowers, but it would also reduce the systematic risks facing the financial system.

Free-market fundamentalists will argue that such command-and-control regulations would prevent some borrowers from purchasing their first homes, thereby impeding their ability to build up equity capital. This may be, but other incentives could always be offered to help low- and middle-income families save money for future homeownership, such as a tax deduction for rental payments to match the current mortgage interest rate deduction for homeowners.

The Mother of All Deregulation

The Clinton administration’s free-market program culminated in two momentous deregulatory acts. Near the end of his eight years in office, Clinton signed into law the Gramm-Leach-Bliley Financial Services Modernization Act of 1999, one of the most far-reaching banking reforms since the Great Depression. It swept aside parts of the Glass-Steagall Act of 1933 that had provided significant regulatory firewalls between commercial banks, insurance companies, securities firms, and investment banks.

It may be helpful to consider what has become of the old Federal Reserve Regulations W and X, the old margin requirements on consumer and housing loans. Since the gutting of Glass-Steagall, the new Regulation W deals with transactions between commercial banks and their securities affiliates. Federal regulatory resources, which in the past were directed to the safety and soundness of mortgage and consumer loans, are now redirected to the opaque transactions between affiliates within financial conglomerates. The former regulatory effort was prudential and preventive in nature, the latter more akin to monitoring the problem only after the horse had left the barn.

Wall Street had been lobbying for years for an end to Glass-Steagall, but it had not received much support before Clinton. Among those with a personal interest in the demise of Glass-Steagall was Robert Rubin, who had months earlier stepped down as treasury secretary to become chair of Citigroup, a financial-services conglomerate that was facing the possibility of having to sell off its insurance underwriting subsidiary. Although Rubin openly boasted of his lobbying efforts to abolish Glass-Steagall, the Clinton administration never brought charges against him for his obvious violations of the Ethics in Government Act.

Rubin also appealed to liberal sentiment. He claimed to have urged Congress and the White House to preserve the Community Reinvestment Act (CRA), which sought to prod banks to channel a portion of their lending to poor, inner city areas. But there was already widespread evidence that CRA was falling short by permitting banks to engage in meaningless reporting requirements in place of substantive investment in low- and moderate-income communities. The real action was not CRA renewal but the demise of the Glass-Steagall firewalls. Banks were suddenly free to load up on riskier investments as long as they did so through affiliated entities such as their own hedge funds and special investment vehicles. Those riskier investments included exotic financial innovations, such as the complex derivatives that were increasingly difficult for even experts to understand or value.

In 1998, the sudden meltdown and bailout of the Long-Term Capital Management hedge fund showed the dangers of large derivative bets staked on borrowed money. But by March 1999, Greenspan was once again praising derivatives as hedging instruments and as enhancing the ability “to differentiate risk and allocate it to those investors most able and willing to take it.”

In 1993, the Securities and Exchange Commission (SEC) had considered extending capital requirements to derivatives, but such proposals went nowhere, and Wall Street lobbied to prevent any regulation of derivatives. Then in December 2000, in his final weeks in office, Bill Clinton signed into law the Commodity Futures Modernization Act, which shielded the markets for derivatives from federal regulation.

Since then, derivatives have grown in size and become gigantic wagers on the movement of interest rates, commodity prices, and currency values. First came the CDO bubble, which acted as a transmission belt by which the subprime mortgage cancer metastasized and spread through financial institutions around the globe. Warren Buffett, legendary investor and chair of Berkshire Hathaway, would soon refer to such derivatives as “weapons of mass destruction.”

Since the collapse of the CDO market, the next derivatives bubble may be the market for credit default swaps, which are credit insurance contracts designed to cover losses to banks and bondholders when companies fail to pay their debts. Today the notional amount of the credit default swap market is at least $45 trillion, about half the total U.S. household wealth and about five times the national debt.

When Bear Stearns melted down this past spring, it was holding $2.5 trillion in credit default swaps that were worth perhaps $40.3 billion in fair market value. The run on Bear Stearns was largely caused by the collapsing mortgage and CDO markets. But it was the market for credit default swaps that may have led the Federal Reserve to intervene. If Bear Stearns had been allowed to fail, countless counterparties on these credit default swaps would have faced enormous losses. The shock waves could have taken down major insurance companies.

This is why George Soros, billionaire hedge-fund manager, has voiced his fears about the unregulated market for credit default swaps. According to Soros, the prospect of cascading defaults hangs over the financial system like a sword of Damocles. He has not called for outlawing the market but for its regulation by establishing a clearinghouse or exchange for the market, capital requirements, and strict margin requirements for all existing and future credit default swap contracts.

Chickens Come Home to Roost

History should deal harshly with Bill Clinton. Throughout his terms, real wages stagnated, manufacturing and service jobs moved overseas in large numbers, and the middle class was squeezed. With the federal government asleep at the wheel, there was a significant rise in predatory lending practices by banks and mortgage companies. By Clinton’s final years in office, all of these trends had contributed to an ominous rise in delinquencies and foreclosures on subprime mortgage loans. This was particularly pronounced in urban America. In Chicago, for instance, foreclosures on subprime mortgages rose from 131 in 1993 to more than 5,000 in 1999.

By the time Bush took office in 2001, the Federal Reserve was once again stepping on the accelerator. The collapse of Enron, a wave of corporate governance scandals, and then the September 11, 2001, terrorist attacks were a drag on economic activity, and so the Fed lowered interest rates from 6 percent to 1 percent between January 2001 and June 2003.

The lower interest rates helped revive the stock market and housing bubbles. It was like pouring gasoline on a fire. By July 2005, the Economist was referring to the U.S. housing market as “the largest financial bubble in history.” Some officials began to sound the alarm. The debt of American households was climbing nearly 20 percent a year, the savings rate had fallen below zero, and the cash being pulled out of homes from mortgage refinancings had reached about 5 percent of GDP. This fueled an enormous consumption binge and a growing trade deficit that put downward pressure on the dollar. Oil producing countries, paid in dollars, began raising oil prices to make up the difference.

It was clear the housing bubble had spread into an even larger dollar bubble. Something had to be done. But without margin requirements or any other selective credit controls, the Federal Reserve could only raise short-term interest rates to cool the housing market and encourage household savings. Starting in 2004, the Fed began tapping on the brake, raising short-term interest rates seventeen consecutive times from 1 percent to 5.25 percent over a two-year period.

If Greenspan was worried that the rise in interest rates could lead to panic, he tried not to show it. “The vast majority of homeowners,” he said, “have a sizable equity cushion with which to absorb a potential decline in house prices.”

Greenspan could not have been more wrong. The steep rise in home foreclosures, now at an all-time record high, has contributed to a downward spiral of housing prices, which in turn has contributed to more foreclosures. By last August, there were more than 200,000 monthly foreclosure filings nationwide. For all of 2007, 1.2 million properties—more than 1 percent of all U.S. households—were in some stage of foreclosure, up 75 percent in only a year. By April 2008, about 2 percent were in foreclosure, and nearly 9 percent, some 4.8 million home loans, were past due or in foreclosure.

Losses from the subprime meltdown have surely passed half a trillion dollars, and some estimates now exceed a trillion dollars. Major U.S. financial institutions have turned for help to central banks and sovereign wealth funds from abroad. The housing market is in its worst decline in memory, the dollar is falling to record lows, and the U.S. economy may be heading into recession.

Many observers have linked the costs of the war in Iraq to economic problems at home, and certainly the billions of dollars being spent in Iraq could be better invested in the nation’s declining infrastructure. But perhaps most overlooked has been the adverse impact of the war on the value of the dollar and the price of oil. As America’s standing has declined in the world, in large part a result of this war, the dollar and dollar-denominated investments have also suffered. Past U.S. housing declines, such as during the savings and loan crisis of the late 1980s, were somewhat shielded from global financial forces. With the rise of the euro and the yen as viable alternative currencies, a declining dollar now poses a far greater threat to continued American prosperity than in the past.

The war in Iraq, along with the erosion of trust in U.S. financial institutions, will likely continue to undermine the dollar’s role as the world’s transactional currency, reserve currency, store of value, and safe investment haven. As the dollar continues to fall, higher inflation will be imported into the United States, and the Federal Reserve may find itself unable to reduce interest rates aggressively enough because of fears of inflation and the need to defend the dollar. It will likely seek new ways to push liquidity into the banking system, but as in Iraq itself, this is unfamiliar and uncertain territory.

With the slowdown in the U.S. economy, governments at all levels—federal, state, and local—have been badly crippled by declining tax revenues. A Democratic Congress and Republican president responded with a $168 billion fiscal-stimulus program consisting of rebates of about $600 per taxpayer to put money back in the hands of consumers. Once again, the Federal Reserve is stepping on the accelerator, cutting interest rates aggressively to try to reinflate the bubble economy. Only now the Fed’s room for maneuver is cramped by the weak dollar and renewed inflation.

Lessons From the Panic

Thomas Paine once suggested that panics have their uses. Their peculiar advantage, he wrote, is that they are “the touchstone of sincerity and hypocrisy, and bring things and men to light which might otherwise have lain forever undiscovered.”

The present panic in our markets should bring to light a number of hypocrisies. Perhaps the first is that there was some significant difference between the economic policies of Clinton and Bush. It is true that the Bush tax cuts contributed to a rising federal deficit, but the Clinton years were also marked by large public deficits. It was only at the end that Clinton saw any surplus and that was after racking up more than a trillion dollars in federal debt. Moreover, the Clinton surplus was a function of several troubling trends, including the administration’s never-ending policy of fiscal austerity. In fact, federal spending fell to about 18 percent of GDP, the lowest level for the end of any presidency since those of Dwight Eisenhower and, before that, of Herbert Hoover.

Another factor that contributed to the final Clinton surplus was the inflated U.S. dollar and huge capital inflows that were attracted to dollar-denominated investments, all of which pumped up economic growth and tax revenues. It was therefore Clinton’s commitment to the Washington Consensus platform of free trade and unrestricted capital mobility that made those hot money inflows possible while also setting the stage for the reversal of portfolio capital flows and today’s declining dollar.

During Clinton’s first three years in office, the federal government borrowed more than $1 trillion, much from abroad. Then between 1996 and 1998, foreign ownership of U.S. government securities rose 26 percent, from $669 billion to $847 billion. Under Bush, foreign ownership of U.S. government securities rose another 88 percent to $1.6 trillion by 2005.

During the Clinton years, mortgage debt grew by nearly two-thirds, from $4.1 trillion to $6.8 trillion. Under Bush, mortgage debt then doubled to $13 trillion in 2006. Likewise, under Clinton, consumer debt doubled from $856 billion to $1.7 trillion. Under Bush, it grew by another one-third to $2.3 trillion in 2006.

Much of this debt was borrowed from foreigners flush with dollars, a result of our huge trade deficits. This was the underside of the Clinton bubble economy, and it set the course for the Bush years. U.S. trade deficits also translated into increased foreign ownership of corporate America. Foreign ownership of U.S. corporate stocks and bonds rose nearly 50 percent in Clinton’s final three years, from $1.9 trillion to $2.8 trillion, and then another 53 percent under Bush to $4.3 trillion.

A comparison of all foreign-owned assets in the United States, including U.S. government and corporate securities, foreign direct investment, and private debt, shows remarkable similarities between the administrations. In Clinton’s final three years, foreign-owned assets in the United States rose nearly 30 percent from $5.9 trillion to $7.6 trillion. Under Bush, foreign ownership of U.S. assets rose by another two-thirds to $12.7 trillion by 2005.

The idea of market discipline is another hypocrisy revealed by the present panic. The Washington Consensus preaches private competition, transparent markets, and less government regulation. Although many mortgage borrowers have been subject to ruthless, unfettered competition, investment banks and hedge funds are increasingly protected by hidden subsidies. Thanks to the combination of deregulation and Federal Reserve bailouts, profits were privatized while the losses are now socialized.

For instance, when the subprime mortgage crisis started spilling into CDOs and credit markets last July, the Federal Reserve began purchasing billions of dollars of government securities to stabilize the markets as well as the solvency of its financial constituents. On August 9, 2007, the Fed injected $19 billion into the financial system. The next day it purchased another $38 billion. This was coordinated with the European Central Bank, which injected more than $200 billion in euros during the same two-day period. The Bank of Japan also reportedly added liquidity to the marketplace. Likewise, in the final week of December alone, the European Central Bank injected almost 350 billion euros (about $502 billion) into the market through purchases from ailing financial institutions.

Such central bank subsidies are largely hidden from public view. When they become visible, you can be sure that the situation is serious. Last December, the Fed announced a new Term Auction Facility to allow commercial banks to borrow from the Fed at subsidized interest rates and against a wider range of assets, such as their holdings of CDOs and other “dodgy collateral.” Within weeks it was reported that banks had quietly borrowed about $50 billion via this new credit facility. In mid-March, as the crisis spread beyond commercial banks to Wall Street investment houses, the Fed dusted off powers it had not used since the Great Depression, when it announced that it would lend its primary dealers in the bond market more than $200 billion in Treasury securities for a month at a time and would accept ordinary mortgage-backed securities as collateral. As the Financial Times reported, this took the central bank “a step closer to the nuclear option of actually buying mortgage-backed securities in its own right.”

In each of these central bank operations, there has been no public debate among elected officials, no checks, no balances. These market interventions are often reported only after the fact, if at all. Yet these subsidies dwarf in size the fiscal-stimulus packages and other programs of assistance for borrowers facing foreclosure.

A number of Wall Street institutions have looked overseas for help. Under Robert Rubin’s leadership, Citigroup and its various affiliates loaded up on CDOs and other mortgage-backed securities. After billions of dollars in losses, Citigroup was forced to raise more than $40 billion in new capital to shore up its balance sheet, and it turned for help to the Persian Gulf state of Abu Dhabi for an infusion of $7.5 billion in new capital. Morgan Stanley, UBS, the Blackstone Group—the list goes on of investment banks that have turned to sovereign wealth funds for bailout from foreign governments, including some rather repressive, antiliberal, and antidemocratic regimes.

Bear Stearns, the fifth-largest investment banking firm in the United States, facing mounting losses in the CDO market, at first found its own “red knight” in Citic Securities, a Chinese state-owned investment firm. But the meltdown continued, and JP Morgan Chase, the third-largest banking institution in the United States, was likely exposed to Bear Stearns through huge holdings of credit default swaps. The Fed stepped in to close down Bear Stearns and arrange a shotgun wedding. JP Morgan purchased Bear Stearns for pennies on the dollar, with the Federal Reserve Bank of New York agreeing to fund up to $30 billion of the less-than-liquid assets acquired by JP Morgan.

Because the Fed’s bailout strategy is targeted to the top of the financial pyramid, it has done nothing to stem the decline in the mortgage market. Senator John McCain has voiced the conservative view that homeowners should not be bailed out and that the housing market should be free to find its natural bottom.

Others have seen the mortgage market as quicksand, pulling down leading financial institutions no matter how hard the Fed bails out their investments in CDOs. They also point out the dangers of letting the housing market fall, particularly in today’s globalized environment, with a declining dollar and skittish foreign investors. The bottom of the market may be much deeper and more painful than voters will tolerate.

Leading Democrats in Congress, such as Senator Chris Dodd and Representative Barney Frank, have proposed funding for new or existing government agencies to purchase underlying mortgages and refinance them at low, fixed interest rates to keep people in their homes and arrest the downward spiral in housing and credit markets. Such plans have good historical precedent. The Home Owners’ Loan Act and the Farm Mortgage Act of 1933 provided mortgage refinancing for tens of thousands of farmers and homeowners facing foreclosure.

In April, the American Federation of State, County and Municipal Employees (AFSCME) called on investors at Citigroup’s annual shareholders meeting to support a plan to split Citigroup’s investment banking from its commercial banking divisions. The breakup plan questioned “the viability of the Citi business model,” an implicit indictment of Rubin himself for his role in dismantling the Glass-Steagall regulatory firewalls.

Financial deregulation and central-bank autonomy were supposed to make the U.S. financial sector stronger. Financial innovation was among the great American exports, along with the model of an independent central bank. The Federal Reserve, insulated from public politics, was supposed to be the guarantor of price stability. Instead, the Fed has presided over what has been one of history’s greatest financial bubbles.

Moreover, while trillions of dollars were channeled into housing and stock market bubbles, the public sector remained woefully underfunded. This, too, has been the legacy of the Clinton-Bush bubble economy: fiscal austerity and budget cutbacks in physical and social infrastructure, from structurally deficient roads and bridges and inadequate water and sewage systems to the collapsing levees around New Orleans and declining public education everywhere.

Unfortunately, the myth of the Clinton economy has too often served to limit discussion about the political forces behind the present crisis in the Washington Consensus. For instance, Hillary Clinton, in promising a high-level emergency panel to recommend ways to overhaul at-risk mortgages, proposed in March that such a council of wise men should include two of the people most responsible for undermining the integrity of financial markets, former treasury secretary Robert Rubin and former Federal Reserve chair Alan Greenspan.

The present crisis in the Washington Consensus should present an opening to think anew about the role of government and the meaning of democracy in a mature capitalist economy. There is an obvious need for prudential regulation—selective credit controls, margin requirements, minimum down payments, and other sensible lending standards. One could analogize to traffic regulation, but we could also look to history.

The Greatest Generation was able to invest on a scale much greater than today, spending billions of dollars on the Second World War, the Marshall Plan that rebuilt Western Europe and Japan, and the G.I. Bill of Rights that housed, educated, and integrated more than sixteen million returning war veterans. As a percentage of GDP, the U.S. government spent more than twice as much and borrowed more than fifteen times as much as today. But it borrowed at near-zero interest from domestic instead of foreign sources. What made this possible was a Federal Reserve that was strictly accountable to the elected branches, that imposed selective credit controls to prevent inflation in asset markets, and that steered funds away from private speculative activities and into long-term public investment in physical and social infrastructure. This period in public finance, spanning the war years and the early cold war period, presents an alternative paradigm to the bubble economy of the Washington Consensus.

Timothy A. Canova is the Betty Hutton Williams Professor of International Economic Law at the Chapman University School of Law in Orange, California.