The Habitation Economy

The Habitation Economy

The core analytic framework for economists on the left has not changed in nearly a century. We need a new paradigm to make sense of the world we inhabit.

In 1980, Margaret Thatcher made her fateful statement that “there is no alternative” to the free market economics that she claimed would revitalize the UK economy. While her policies did not produce the promised results, it remains true that in most places, advocates of more egalitarian and inclusive public policies have been unable to win national office for more than a single consecutive election cycle. Despite frequent claims of its imminent demise, neoliberalism still exerts considerable power in the global economy.

Why is it that efforts to generate broad, durable majority support for egalitarian economic policies have so far failed? Part of the explanation is that advocates of alternative economic policies have continued to operate within the confines of existing economic theories. For the most part, the core analytic framework for economists on the left has not really changed since the 1930s and ’40s.

This is a problem because the economy has changed radically. We need a new paradigm to make sense of our current economy—and to offer a persuasive policy agenda that gives those at the local level the resources and mechanisms they need to shape what they consume and produce.

What Kind of Economy Do We Have?

Since the 1960s, some scholars, including myself, have used the concept of postindustrialism to explain the transition from an industrial society to one that is heavily dependent on science and technology, and where consumption has shifted toward services—usually intangibles or ephemeral outputs like education or restaurant meals. But the concept never really took root. For one, it was politically defeated by free market ideologues who falsely claimed that neoliberalism would solve the economy’s problems. And furthermore, postindustrial theorists were unable to identify the structures central to that historical stage, as the factory was to industrialism or the farm to agricultural society.

It is evident now that what follows industrialism is a habitation economy, in which most people work at producing, maintaining, or enhancing the soft and hard infrastructure of the communities in which they live. In industrial society, this work tended to happen in the background; as theorists of social reproduction have explained, much of it was done by women, or by men during their time away from waged work. Today, however, if one considers construction, healthcare, education, local government, retail trade, transportation, communication, entertainment, and the innovation economy, it turns out that most employed people are habitation workers. Most of us also do such work unpaid in our spare time.

But while most of the economy is devoted to these areas, we are not getting the habitation we would choose. We have an acute shortage of affordable housing, resulting in homelessness, excessive rents, and punishingly long commutes. Poverty, inequality, and despair in our cities, suburbs, and towns contribute to drug addiction and crime. Rural areas and small towns also lack employment opportunities, essential infrastructure like cell phone towers, and adequate services. Parallel problems exist with healthcare, education, child care, elder services, and financial services.

To understand how we ended up here, we need to revisit the ground rules and economic categories of the industrial era. And we need to abandon the idea that markets will balance supply and demand.

The Decline of Traditional Commodities

Economics since Thomas Malthus and David Ricardo has focused on the production of standardized commodities, available from multiple suppliers, that are transferred in a single moment in time. These qualities are essential to the claim that there are no power differentials in a market economy. If a provider is charging too much or their products are substandard, the buyer can easily switch to another producer. Exit is a powerful tool to discipline market actors.

But most of the things produced and consumed today do not fit this definition of a commodity. People mostly consume services or destandardized goods. Most services are not standardized, either, and they involve relations over time. Whether one owns a home or rents, it involves an extended relationship, and exit is costly. Similarly, few patients will leave the hospital when told the cost of a needed medical procedure. It is true that we change banks, cell phone carriers, and insurance companies, but it takes time, and there is little guarantee that the new firm will be any less annoying.

We still pretend that everything we buy is a commodity. Our visits to the hospital are coded into categories for insurance reimbursement as though the transactions were as transparent as the receipt we get at the supermarket. These bills, however, are bureaucratic fictions, as are similarly incomprehensible bills from utilities. The official charge for a medical procedure could be $1,000, even though the provider accepts $150 from the insurer as full payment.

Most U.S. firms have also figured out that it is difficult to make money selling a standardized good. Chances are a foreign firm can produce it at a much lower price point. U.S. firms, even when they move production overseas, create highly differentiated product lines. Almost every product you can think of has been destandardized, from staples such as beer and bread to automobiles, mattresses, appliances, clothing, and pharmaceuticals.

With destandardization, products quickly become incommensurable. There is often no way to calculate an exact trade-off between price and features. Most of us tend to rely on brand names to make these choices, but that can mean simply rewarding the firm with the biggest advertising budget. Moreover, with many of the more expensive goods, such as automobiles and appliances, the transaction extends over time because there are warranties and service contracts.

Consumption patterns dominated by services and destandardized goods have shifted power to producers. Taking one’s business elsewhere tends to be costly for the consumer. There is also a substantial information imbalance between buyers and sellers, and it is expensive for consumers to spend time trying to narrow this gap. This power differential has been intensified by forty years of lax antitrust enforcement, which has led to high levels of concentration in many markets for both goods and services.

While government is heavily involved in many of these markets as both regulator and funder, its power is only occasionally used to protect consumers. Firms offering cable television, electricity, and cell phone service are providing public utilities, but in most cases they have effectively co-opted the regulators. Local governments regulate the housing market with zoning and building codes, and the federal government underwrites most of housing finance—yet these powers have not been used at the scale needed to expand the supply of affordable housing.

In short, we have been relying on markets to equilibrate the supply and demand for all kinds of things that do not resemble classical commodities. It is therefore hardly surprising that these markets do not work as economic theory claims.

Changes in Production and Innovation

Destandardized goods and many services require high levels of innovation. Differentiating one’s products requires thinking of new features and new ways to produce. Innovation is also inherent in services such as health, education, communications, entertainment, and even financial services. In healthcare, for example, there is a constant search for new drugs and procedures to fight disease and provide people with more quality years of life.

Some of this search for novelty is superficial, even ridiculous. Many newly invented beverages and food items end up with very short half-lives. However, the personal computer, the smartphone, the electric car, LED bulbs, lithium batteries, new composite materials, RNA vaccines, and other inventions of recent decades represent significant advances. Moreover, in the arena of entertainment and cultural products, most of us want to see things that are different from the art, music, and literature we might have consumed decades ago.

It follows that an economy that prioritizes destandardized and often novel goods and services will operate differently from an industrial economy focused on standardized products.

Standardization was historically connected to two other organizational innovations: vertical integration and Taylorism. All three were exemplified in Henry Ford’s industrial designs. Ford—who allegedly said that the customer could have a Model T car in any color, so long as it was black—carried vertical integration further than anyone else. In the River Rouge plant, his company produced both the steel and the glass needed to make his cars. Ford’s logic was that the more stages of production he managed, the more of the profit stream he would control. This logic made sense precisely because he was producing very large quantities of a highly standardized product.

Ford’s assembly line was a physical representation of Frederick Winslow Taylor’s early-twentieth-century managerial advice to separate conception from execution. In place of the craft worker, who combined those functions, Taylor insisted that managers should do the conceptual work and production workers follow a simplified script. The assembly line put this into practice; each workstation involved a few repetitive tasks that required little or no thought.

In an economy that prioritizes destandardization and innovation, we see in almost every sector a move toward collaborative network production. There are many ways to organize network production, but they are all a response to the downside of vertical integration. The units that made the steel and glass at River Rouge had a guaranteed market for their output and little incentive to be more efficient or to innovate. Under a destandardized system, by contrast, there is every reason to partner with firms that have cutting-edge expertise in making glass, steel, and automotive computers.

One of the classic models of collaborative network production was developed by Toyota as it moved from mass production to lean production. Auto companies had routinely bought parts from supplying firms while negotiating the lowest possible price, and they often shifted from one supplier to another. Toyota instead set up a long-term collaborative relation with its subcontracting firms, guaranteeing those firms a profit on their production so long as those firms were constantly innovating and cutting costs.

Apple’s version of cooperative network production features outsourced production of iPhones to Foxconn—a Taiwanese firm that operates giant factories in mainland China. Apple engineers spend a great deal of time in the Foxconn plants to ensure that the factory sustains a very high level of defect-free production. In contemporary Hollywood, to take another example, most films are made through collaboration among many small firms that represent the actors, the sound engineers, the director, the filmmakers, and other important groups, but large production companies organize the distribution and the marketing.

Collaborative network production depends on high levels of expertise, and it is impractical and inefficient to try to have so many experts working for one firm. Most sophisticated technological innovation now happens in large government laboratories or government-funded research institutes where scientists and engineers on the public payroll work alongside scientists and engineers from outside firms.

Some collaborative network production still relies on significant numbers of poorly compensated workers with limited skills. New internet firms, for example, often depend on low-wage workers in call centers to help customers work with software or apps that still have many defects. And Amazon operates a high-tech version of Taylorism to manage warehouse workers. However, in systems of lean production, even assembly-line workers are trained to identify problems that might cause defects, and they are encouraged to propose changes in production that might improve product quality. In teams working on innovation, there are continuously problems to be solved, and sometimes important ideas come from people without advanced degrees.

One sees something like collaborative network production in the largest service-sector organizations. Until quite recently, many of the physicians working in hospitals were not employed by the hospital. University faculty members are employed by their institutions but are granted a much higher level of autonomy in their teaching and research than any other category of employees.

Our economy is dominated by very large corporations where the people at the very top still make almost all of the important decisions, and are compensated at levels that are many times what ordinary employees make. But today, most things are produced in systems of collaborative network organization where success depends on the input and expertise of many different employees, often spread across different organizations.

What Counts as Investment?

All these transformations in production and consumption have major implications for the tools of economic analysis. One of the most important is the concept of investment—the expenditures intended to increase output over multiple years, as opposed to outlays for consumption and goods that are used up in the production process. Much economic policy is designed to increase overall investment in order to expand the economy’s ability to produce goods and services. Our tax code, for example, is very generous to businesses in the hope that they will increase investment spending.

Economists’ basic approach to investment was formed in the industrial era, when farms and factories dominated production. In 1947, when the Department of Commerce first released the National Income and Product Accounts to track changes in the economy, only expenditures on machinery, transportation equipment, and buildings counted as investment. It took until 1996 for government accountants to acknowledge that public outlays to build roads, bridges, and airports should be included in the investment category. Even now, Commerce Department statisticians do not recognize household purchases of automobiles and major appliances as investments.

Some economists have been pointing out for decades that just as the economy produces intangible things such as services, there is also a rising amount of intangible investment. One obvious category is the increasingly complex software that runs on computer hardware or is incorporated into vehicles, appliances, medical equipment, and many other products. If the purchase of a computer counts as an investment, then the cost of the software that enables it to do useful things should, too.

It follows that much of the money spent on the research and development behind scientific discoveries and new products should also count as investment. Similarly, the outlays needed to create original cultural products including literature, movies, television shows, and recordings should count, as long as they are intended to be sold over multiple years.

Most economists have also been arguing that money spent to raise the knowledge and skill level of the population creates “human capital,” which makes it a critical form of investment. But the Commerce Department does not count these expenditures as investments. There seem to be two reasons for this resistance. The first is that economists disagree about the proper way to measure human capital expenditures. The second is that outlays to raise knowledge and skills are quite large relative to other types of investment. Revising the data to include human capital outlays would dramatically change all of the size and growth pattern estimates for GDP. This is something that statistical agencies are very reluctant to do.

The consequence is that the official data that economists employ in their analyses are not based on the definition of investment that most people in the discipline have adopted. And how can you make sense of economic growth when the data you have is based on an incorrect measure of total investment?

Feminist scholars have developed an alternative paradigm using the concept of social reproduction. They point out that all of the work that goes into raising children into adults and teaching them the things required to make them into productive and socially skilled human beings should be understood as investment; we would not have achieved current levels of economic output without them. It follows that a comprehensive measure of investment must include not only the expenditures for tangible and intangible investments tracked by the Department of Commerce, but also outlays for education, training, and out-of-home child care as well as the unpaid labor of family members devoted to child-rearing. In addition, a significant portion of healthcare outlays should be included since they are needed to keep people healthy enough to be productive, as should household purchases of vehicles and major appliances. Income maintenance outlays such as food stamps and unemployment insurance are also investments since they support families during periods of economic hardship.

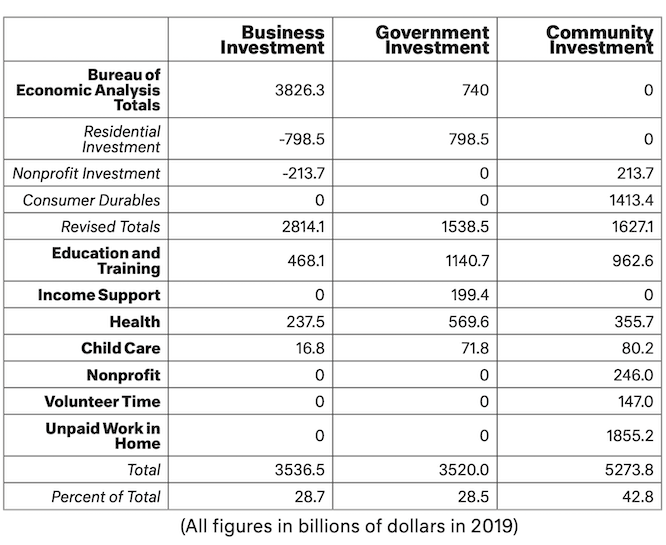

Something surprising happens when one recalculates the levels of investment in the economy through the framework of social reproduction (see Table 1). For this exercise, the economy is divided into three sectors: business, government, and community, which encompasses both households and nonprofit organizations. As a result of the growth in intangible investments over the past sixty years, most investment is done by the community and government sectors, and business investment represents as little as a quarter or a third of total investment.

We are told over and over again that government must balance budgets without raising taxes on business or the wealthy since their investments are critical for our prosperity. Similarly, firms warn that if wages rise, it will endanger profits and cut off the critical investments that business makes. In short, the justification for austerity is always to assure a continuation of business investment.

Table 1: Comparing Investment With the Social Reproduction Paradigm

However, if household and government expenditures are actually the key to allowing us to improve living standards, then all of these arguments go out the window. Instead, we should maximize public sector investment and increase wages for the average household. More investment by government and households will induce businesses to increase their own investment, since there will be stronger demand for their products and a more productive labor force.

A New Policy Paradigm

When we start from the idea that our economy produces things that do not resemble classical commodities and that the bulk of investment is now done by households and government, we quickly get to a very different policy paradigm. We can briefly sketch out some of its major elements.

Resources and Democratic Control

The first critical step is to give people greater ability to collectively control the economy. That requires increasing the resources available at the local, state, and regional levels. For many decades, state and local governments have been squeezed by a fiscal crisis. These levels of government have increased demands on their limited resources to fund education, healthcare, the criminal justice system, infrastructure, and so on, but raising taxes risks driving big business and rich people to lower-tax jurisdictions. For a while, the federal government used revenue sharing to address the problem, but that system was ended by Ronald Reagan. State and local politics have become an ugly struggle between different interest groups over limited resources.

To address the long fiscal crisis, tax revenues need to be raised at the federal level and redistributed on a per capita basis to state and local governments. Furthermore, the ability of state and local governments to borrow to finance infrastructure projects has to be enhanced by the creation of nonprofit investment banks that float bonds on much more favorable terms than Wall Street provides.

With more resources, local and state governments would need to construct new mechanisms to increase the public’s voice in key decisions about housing, transportation, energy, infrastructure, education, criminal justice and policing, healthcare, child care, and elder care. Since the market mechanism does not work, this democratic input is necessary to help people get the habitation they want. Moreover, these deliberations would be an opportunity to address the systemic racism that has pushed many people of color into neighborhoods with inadequate services and greater environmental risks. Significant experimentation would need to take place to find mechanisms that would assure such deliberations were not dominated by those who are already privileged.

Some questions might be put to voters in referenda that would allow them to choose among different plans for major infrastructure spending. In other cases, such as healthcare, there could be elections for a county health board that would oversee the delivery of services and serve as an early warning system for abuses such as overprescribing opioids or failing to respond to community health problems. The model of participatory budgeting could be expanded to cover larger shares of municipal expenditures. Citizens’ assemblies modeled on juries, where participants are chosen at random and spend an extended period of time deliberating together, could be used for certain types of decisions.

The feasibility of this sort of program has already been demonstrated with the innovation economy. The federal government has been encouraging the development of local and regional bridging institutions that bring together government officials, business representatives, colleges and universities, and sometimes trade unions to work on encouraging technology-based economic development. These bridging institutions are able to draw on federal dollars to facilitate the creation of industrial clusters around a specific technological innovation. They could work in other sectors, too, but they would need to be broadened to ensure all residents are represented in the decision-making process.

Expanding Public and Nonprofit Provision of Goods and Services

The logic of collaborative network production means there is much more space in the economy for smaller firms, cooperatives, ethical firms organized as beneficial corporations, and publicly owned entities. Since many markets are now dominated by giant corporations, this is a critical way to increase competition in the economy and ensure more effective regulatory policies.

In the health area, for example, certain medications are not being developed or produced by private firms because they are not expected to be profitable, and there are generic drugs being sold for wildly inflated prices because no competitors have entered the marketplace. Why not develop a network of nonprofit drug developers who could collaborate with private firms to produce such drugs at affordable prices?

Similarly, the shortage of affordable housing requires an initiative like the creation of a national network of agencies committed to building homes that are attractive, environmentally sound, and located in neighborhoods with the full range of needed services. This requires learning from the mistake in earlier decades of concentrating poverty in public housing buildings that were not properly maintained.

The same issue pertains to other goods and services. In places where information sources have dried up, why not develop networks of cooperative news producers who are able to share resources to provide public access to quality journalism about local, national, and global issues? Taxi drivers in some cities have already been experimenting with forming cooperatives that allow them to compete directly with the big ride-sharing services. And in Quebec, there have been initiatives to expand the supply of quality child care and elder care by encouraging the creation of new cooperatives to provide these services.

Many of these projects would require government subsidies. In an area like local media, the government could provide vouchers for residents to support a particular news source. That would solve the problem of direct government interference in journalism, and a particular locality might support multiple news outlets with different orientations.

But the more pressing need is for more public options in the financial industry. This means creating more nonprofit banks and other lending agencies that would be able and willing to provide financing to firms that do not fit the traditional corporate model. It also means expanding the public option on the investing side, allowing individuals to save for retirement using funds that support such efforts, instead of subsidizing the big investment management firms.

Moreover, this policy approach requires vigorous enforcement of antitrust rules. Large corporations have access to huge pools of funds and often control resources that make it difficult for smaller firms to compete. Giant food companies, for example, pay supermarket chains to devote space to their products, so that there is little room left for smaller competitors, even those with better products. These restraints on true competition need to be dismantled.

Global Reforms

Any nation or economic region that begins moving toward a democratized economy is likely to meet resistance within the global financial system, which has been structured to enforce neoliberal orthodoxy. Once a country’s government increases its borrowing and facilitates wage increases for workers, its bond ratings will be lowered and its currency will be devalued in foreign exchange markets. Moreover, rich people and businesses are likely to rush to transfer assets abroad, putting further downward pressure on the exchange rate.

It is therefore an urgent priority to overhaul the rules and institutions governing the global economy that have reproduced inequality, increased international tensions, and blocked more effective responses to environmental crises. There are several initial steps that would open up space for effective experimentation with new policy paradigms, both within nations and transnational regions.

First, the lending power of the International Monetary Fund and the World Bank needs to be dramatically increased. This is necessary to produce sufficient levels of spending on renewable energy and energy conservation in every nation to confront the challenge of climate change. At the same time, lending criteria need to be disconnected from neoliberal ideology so that states will have open lines of credit to combat capital flight.

Second, it is finally time to establish a global financial transaction tax, which would significantly reduce the profitability of speculating on currencies and a range of derivative instruments used to bet against a nation’s bond ratings.

Third, it is necessary to close down the tax havens where very rich people hide their money to avoid reporting their income and assets to tax authorities. If taxation is the price we pay for civilization, then these tax havens are instruments of barbarism.

Finally, we should return to an idea that was suggested when the proposals for the International Monetary Fund were first debated: funds that are sent abroad in violation of a nation’s capital controls should be seized by the receiving country’s government and returned to the originating nation’s tax authorities. Existing global rules to fight organized crime and money laundering mean that such tracking is completely feasible.

Another world is possible. To get there, we must make a definitive break with the frameworks we have inherited from the industrial era, which no longer make sense in an economy of primarily non-standardized goods and services. By seeing the economy through the lens of social reproduction theory, we open the path to investing in ourselves.

The very rich, entrenched corporations and their reactionary allies will resist the agenda outlined here. Progress will require organization and mobilization in both civil society and the arenas of elections and legislating. But there is an enormous advantage in waging such struggles when we can present our fellow citizens with a realistic and practical way forward that makes sense of their lived experience.

For more than a century, the vision of a socialist alternative did just that for factory workers and their allies. For the past half-century, for many reasons, it has not been possible to build majoritarian movements behind a socialist banner. It might, however, be possible to construct such majoritarian coalitions in pursuit of democratizing our habitation and protecting the planet from environmental devastation. Such an effort would build on the best parts of the socialist tradition—the commitment to democracy, equality of all people, and a society constructed to meet human needs.

Fred Block is president of the Center for Engaged Scholarship. The Center supports PhD students whose work can contribute to struggles for social, economic, racial, gender, and environmental justice.