Gilt Trip

Gilt Trip

How the “Boston Brahmins” of the late nineteenth century laid the foundations for modern American capitalism.

Brahmin Capitalism: Frontiers of Wealth and Populism in America’s First Gilded Age

by Noam Maggor

Harvard University Press, 2017, 304 pp.

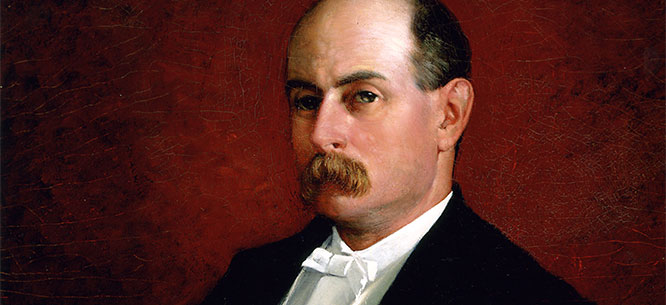

What do a depressed ornithologist, a dissatisfied property manager, and a failed plantation owner from the 1870s have in common? A hefty inheritance, family connections, and membership in a generation of Boston financial elites who, in Noam Maggor’s new book, laid the foundations for the emergence of modern American capitalism. In examining how “Boston Brahmins”—including Henry Davis Minot, Charles Francis Adams, Jr., and Henry Lee Higginson, among others—preserved their wealth and status at the close of the nineteenth century, Maggor rethinks a question central to the history of the Gilded Age. How did the United States transform, within the span of a few decades, from an agricultural exporting nation into the world’s leading industrial economy? Brahmin Capitalism argues that historians have placed too much emphasis on the wave of corporate mergers that transformed manufacturing during the 1890s, while taking for granted the creation of an integrated national market that made industrial consolidation possible. To examine how a market connecting the northeast and the Great West formed during the last quarter of the nineteenth century, Maggor deploys one of the hallmark methods of recent histories of capitalism: he follows the money.

Brahmin Capitalism traces how, in the aftermath of the Civil War, a generation of Boston brokers reoriented their investment portfolios away from plantation slavery and textile manufacturing and toward new industries in the west. By shifting resources from flagging New England mills to mining, railroad, and stockyard ventures across the Mississippi, northeastern investment bankers laid the financial groundwork for a nationally integrated market. They poured inherited wealth into failing industries. They purchased, distributed, and underwrote securities that made possible the capitalization of large-scale industrial corporations. They used gifts to cultural institutions like museums and universities to shore up their political influence. In doing so, they made continental industrialization financially possible, legally sanctioned, and ideologically palatable.

Maggor builds on scholarship that has challenged earlier narratives of the Gilded Age as a period when a night watchman state allowed private market forces to operate unencumbered. His key contribution to this literature stems from attention to how municipal politics in the east and territorial politics in the west jointly fueled industrialization. By uncovering the crucial role of eastern finance capital in underwriting western industries, Maggor demonstrates that two central features of the post–Civil War United States—continental expansion and economic industrialization—developed together. This Gilded Age was not a time for upstart entrepreneurs to pull off Horatio Alger–style feats by bootstrapping. Nor did it produce the blow to moneyed elites that historian Richard Hofstadter described in the 1950s. It was instead a moment in which established wealth played a decisive role in organizing the new industrial political economy.

In rethinking the origins of industrialization in the United States, Brahmin Capitalism asks a larger set of questions about the relationship between private wealth and political power. Markets, Maggor reminds us, do not emerge spontaneously out of the decisions of private economic actors. They are inescapably political creations. To grasp how the unprecedented profits garnered by western industrial corporations came to be seen as reasonable returns on investment, he argues, we need to understand how the Boston Brahmins institutionalized their ideas about what constituted legitimate economic activity in politics and law.

Eastern investment bankers eager to expand into western industries faced ongoing pushback from grassroots activists who shared what Maggor calls a “producerist” approach to America’s political economy. This was a vision in which capital amassed through investment should be redistributed to those who created wealth through “labor and toil.” Rather than focusing on the usual suspects associated with Gilded Age dissent—the People’s Party, labor unions, or muckraking journalists—Maggor’s populists are a somewhat eclectic group. They include working-class Bostonians who sought publicly financed amenities like running water and affordable housing; a Mechanics Association demanding access to a public park to showcase their trade; and Western settlers fighting to limit the ability of out-of-state corporations to monopolize natural resources within their territories. These are the small “p” populists who advanced visions of a “capacious democratic state” that challenged financial elites’ attempts to dictate the terms of the new industrial order.

The Populist Party of the 1890s famously articulated demands that could only be realized at the scale of federal politics: nationalized railroads, a graduated income tax, the direct election of senators, a new monetary policy, and restrictions on immigration. Maggor’s populists instead looked to the city and state levels of government to create a wider distribution of the wealth generated by industrialization. In the northeastern metropolis of Boston, they sought public investment in urban infrastructure including housing, roads, schools, transportation, and sewage. In western territories such as Washington and Wyoming, their aims included state ownership of water, regulation of railroad rates, workers’ rights, and limits to tax exemptions for corporations. While the populist platform may have lost in the polls at the 1896 presidential election, a populist vision of greater democratic control over economic policy had nonetheless haltingly advanced during the preceding decades through a range of local and state initiatives. If not always successful in their demands, grassroots activists put a wide spectrum of policies on the agenda.

Rival Brahmin and populist models of political economy collided in the realm of taxation and regulation, where battles over wealth distribution had material implications for municipal and state governance. Would city governments use fiscal policy to provide urban improvements for working-class residents? Or would they facilitate the emergence of heavily capitalized industries thousands of miles away by exempting intangible property like corporate shares from taxation? Would Western state constitutions limit the power of corporations to control labor and resources, or court out-of-state investors? Each of these possibilities, Maggor shows us, represented a model of government subsidies for a specific regime of capital accumulation. The “laissez-faire” politics we often associate with lack of regulation was in fact a form of state-sponsored economic development that made it possible for industrial corporations to become profitable.

While grassroots activists challenged the power of financial elites to set the terms of industrialization, Boston Brahmins won the fight over taxation. “Mobile capital,” Maggor notes, “managed to escape taxation almost everywhere.” The west became the original corporate tax haven. When northeastern investors shielded property in out-of-state financial assets from municipal taxation, cities lost the tax base necessary to fund the redistributive projects that working-class Boston residents demanded. Investors gained outsized control over the terms of American expansion policy, leading to spectacular profits for the Brahmins, and narrowed the “ideological confines” for political debate by removing economic policy from the realm of democratic control.

Maggor contrasts the deliberative democratic institutions through which his populists pursued their political agendas to an unelected Supreme Court that shored up corporate power during the Gilded Age. But elections were no guarantee of democratic control over the economy, nor were elected offices necessarily bastions of populism when access to political participation remained restricted. While the Gilded Age Supreme Court consistently favored the interests of industrial corporations, elected judges at the local and state levels were similarly instrumental in consolidating wealth during this period by allowing the owners of mines, ranches, and railroads to secure property titles and control workers through violence. They did so not because they were beholden to distant eastern financiers, but because they themselves often monopolized local economic resources.

The producerist logic Maggor places at the center of populism could also lend itself to undemocratic purposes. The purported need to bring land into cultivation helped justify a wave of federal legislation—including the Homestead Act (1862), the Dawes Act (1887), and the Reclamation Act (1902)—that often concentrated economic resources in the hands of new settlers and development corporations. The contrast Maggor draws between his producerists and Brahmin capitalists understates the ideological malleability of producerism, which infused a wide range of political projects that had very different implications for wealth distribution and democratic governance. Particularly if we expand the boundaries of the west to include southwestern cattle-raising states like Texas and copper-mining territories like Arizona, the settlers who populist rhetoric contrasted with oligarchic corporations start to look less egalitarian.

Skyrocketing economic inequality, the conflation of private wealth with political power, and the removal of economic questions from the realm of political debate: these are problems of the Gilded Age, and of our own time. As Brahmin Capitalism demonstrates, they are not excesses of an era, but products of the political order that emerged from late nineteenth-century battles over wealth distribution in industrializing America.

Not all of those clashes ended in defeat for populists. Maggor cites the patchwork quality of corporate regulation in late nineteenth-century America as an example of partial victory for the producerists and a foil to the dream of a uniform investment landscape for corporations. But the unevenness that Maggor describes also laid the groundwork for capital flight and outsourcing, a legacy we see in “right to work” states and corporate tax havens today.

Brahmin Capitalism asks what it would mean for economic policy to be placed under democratic control. The book uncovers a surprisingly radical model of political economy that populists advanced at the municipal and state levels of government during the Gilded Age. It also suggests that to truly make economic policy democratic, electoral politics might not be enough.

Allison Powers Useche is a Past and Present Postdoctoral Fellow at the University of London’s Institute of Historical Research.