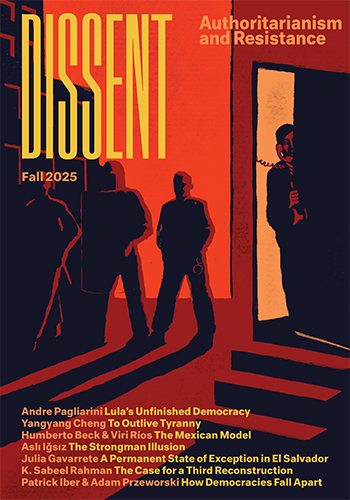

Monetary Democracy

Monetary Democracy

The rules of the monetary system are too important to be left to financial elites. When ordinary people speak up, they often come up with better ideas.

Money, Power, and the People: The American Struggle to Make Banking Democratic

by Christopher W. Shaw

University of Chicago Press, 2019, 400 pp.

The economic crisis induced by COVID-19 allowed the bank to put deeds behind its words. Thanks to BND, according to a May 15 report in the Washington Post, North Dakota awarded more Paycheck Protection Program funds on a per-worker basis than any other state. The PPP was Congress’s attempt to flash freeze small businesses during the coronavirus crisis. It provided forgivable loans intended primarily to keep workers on payroll until normal operations could resume. Unsurprisingly, the major national banks tasked with issuing the money favored their own big clients. Since the loans were basically government grants, they offered little to the banks besides the opportunity to give some extra goodies to the companies they did a lot of business with. Meanwhile, the Federal Reserve backstopped the corporate sector by pledging virtually unlimited purchases of an ever-growing range of financial securities. Writing for the American Prospect, David Dayen observed, “The monopolists get concierge service, the small businesses get to take a number.”

BND made North Dakota different. Because it is accountable to the people of the state instead of shareholders, it has a public mandate that goes beyond its bottom line. This includes supporting community banks to retain their independence even as the financial industry undergoes wave after wave of consolidation. Community banks are intimately familiar with local small businesses. With help from BND, they directed PPP funds to those small businesses, which employ nearly 60 percent of the state’s workers. In this way, BND helped to stabilize North Dakota’s economy and, as of May, keep its unemployment rate among the lowest in the country.

This illustrates how important it is to have a banking system that serves the public interest instead of the investor class. Banks channel the flow of money, and it is the flow that makes money what it is. Much like rocket science, the hydraulics of banking often seem too complicated and too boring to hold most people’s attention. Unlike rocket science, however, banking determines a great deal about most people’s lives. It should not be left strictly to insiders who open and close unseen sluices, assuring us that the good stuff will all trickle down in the end.

The financial historian Adam Tooze declared recently that COVID-19 has swept away the “illusion” that money is “technical, not political.” The people who established BND in 1919 understood this perfectly. They came to power on a wave of grassroots revolt known in North Dakota as the Nonpartisan League and included a former Socialist Party member described by the bank’s centennial history as a “rabble rouser.” They were not unique, as historian Christopher W. Shaw shows in a new book, Money, Power, and the People: The American Struggle to Make Banking Democratic. Shaw recounts how a social movement for the structural reform of money took root in the early decades of the twentieth century. His book offers a powerful lesson in what mass democratic politics can accomplish when people pay attention to the laws and institutions that govern how money is made and channeled.

Money, Power, and the People begins with the Bankers’ Panic of 1907, a financial crash followed by a sharp economic depression. Times were so bad that people in the heart of coal country collected driftwood to warm their homes. A majority of the public blamed bankers’ ineptitude and selfishness. Financial reform became inevitable, kicking off three decades of struggle over what that reform would look like. Shaw deftly covers the many twists and turns, revealing that the struggle was fundamentally about whether private interests or public authorities should set the terms for how money gets created and allocated. While “bankers were united in adamant support for a private banking system firmly under their control,” he writes, farmers and workers pushed for government-run alternatives that would prioritize economic “security, affordable credit, and stability.” The battle to establish the Bank of North Dakota was just one episode in this thirty-year war. Other policy engagements concerned postal savings accounts, farm credit facilities, bank deposit guarantees, and ensuring that the Federal Reserve was overseen by public officials instead of financial insiders. Each of these was a knock-down, drag-out fight, but each was eventually enacted in some form or other. The upshot was a dramatically transformed financial environment that helped make the middle decades of the twentieth century a time of broad-based economic stability and prosperity.

The most remarkable aspect of Shaw’s book is that he documents, as no one has done before, just how many people played a part in this protracted political drama. He pulls evidence from an incredible range of organizations, media outlets, and individuals, many quite obscure—not just the American Federation of Labor but also the Boot and Shoe Workers’ Union; not just the Farm Bureau Federation but also the Farmers’ Holiday Association; not just the New York Times and the Chicago Tribune but also the Dallas Morning News and Oklahoma’s Guthrie Daily Leader; not just Marriner S. Eccles, who famously helmed Franklin Roosevelt’s Fed, but also Alfred W. Lawson, who operated a free night school devoted to financial matters and the proposition that “private banking must be prohibited.”

The social conflict that Shaw reveals is so sprawling and multifaceted that his main protagonist is not really any particular person or group but the field of action itself. Shaw calls it “banking politics”: the conviction that the arcana of money and banking are open to contestation instead of being the private preserve of financial elites. Bankers were deeply disturbed by the eagerness of ordinary people to dissolve the mystique of technical complexity that surrounded financial issues and to bring their own ideas to the table. “Tucked away in pigeon-holes and desk drawers,” complained the ABA Banking Journal in 1932, a moment when public esteem for bankers’ expertise stood particularly low, “are hundreds of plans for restoring prosperity.” Imagine that! Shaw takes us on a tour of those plans—from Jacob S. Coxey’s scheme to fund no-interest state bonds with federal greenbacks to the California campaign for a time-stamped money popularly known as “Ham and Eggs”—to show how heterodox financial thinking steadily gained ground and put bankers on the back heel.

Grassroots ideas shocked the conscience of elite financial orthodoxy, but these very ideas proved both workable and effective. The origin of the Federal Deposit Insurance Corporation offers a notable example. Created during the Great Depression as part of the New Deal, the FDIC is generally understood as the program that ended conventional bank runs. Before it, bank failures were so common that anyone with a savings or checking account lived in a state of perpetual anxiety. Those who could afford to often divided their savings. “If one bank busts, there’ll be some left,” reasoned the baseball Hall of Famer Honus Wagner. Even municipal governments dared not risk putting all of their funds in one place. Yet when farmers’ groups and labor unions began calling for deposit guaranty programs after the 1907 crash, bankers seethed with rage and defiance. Any kind of government involvement was anathema. One bank president insisted that such programs would “crush all industry, paralyze all business.” It turned out to be just the opposite. The FDIC stabilized a core component of the banking system, turning savings and checking accounts into a kind of public utility.

Banking politics reached its high point during the Great Depression when insurgent labor and farmer groups joined FDR’s New Deal coalition. The Banking Act of 1935 made the FDIC permanent and enabled the Federal Reserve to engage in countercyclical monetary policy, the foundation for the extraordinary measures undertaken by the Fed today to avert a chain reaction of insolvencies. The law’s key move was to restructure the Fed’s governance in ways that made it more responsive to the aims of public officials. Playing on the idea of central bank independence—which today means independence from the government—Shaw observes that “the abiding demand of workers and farmers” empowered the Fed to increase its “independence from the banking fraternity.” This was a significant victory that improved the lives of millions of working people. But it fell far short of what many envisioned, and it signaled the decline of banking politics. Over the coming decades the big labor and farm organizations narrowed their focus, claiming a role as responsible governing partners for their own sectoral domains while suppressing the broader adversarial politics they had once championed against the financial establishment. By the 1970s, the public had forgotten about banking politics, and there was less organized capacity to resist financial deregulation. Bankers and “shadow” bankers took back control and gave us the 2008 crash in return.

Shaw concludes with the observation that public apathy about monetary issues “is an anomaly in the grand sweep of American history.” This is true. There is a long tradition of Americans contentiously debating the design of monetary institutions. In the nineteenth century, they clashed over fractional reserve banking, central banking, and the gold standard. Before that they debated whether states should print their own money in competition with the federal government and, earlier still, whether colonial governments could operate public land banks or issue tax-anticipation notes. In light of this history, Shaw sees Occupy Wall Street and the 2016 Bernie Sanders presidential campaign as evidence of a possible revival in banking politics.

I read Shaw as implicitly positing three conditions for a vital banking politics: widespread public interest in financial issues, spirited debate about alternative financial structures, and organizational capacity to turn public sentiment and new thinking into government policy. The first of these is driven by day-to-day financial precarity and anger at elites’ management of our life chances. Frequent bank failures, farm foreclosures, and savage business downswings gave people plenty to be angry about in the period Shaw documents. A century later, the run-up in household debt, the 2008 crash, and now the economic consequences of COVID-19 accomplish the same. Also contributing to public engagement are rapid changes in our routine experiences with money. Payments systems, which used to be dominated by cash and checks, have been transformed by digital technologies, suggesting that radical alterations to the monetary plumbing are entirely possible.

The second condition is also increasingly evident. Since 2008, new ideas about how to reorganize the financial system have proliferated, recalling the “hundreds of plans for restoring prosperity” that, as Shaw observes, so worried the bankers in 1932. From quantitative easing to Bitcoin to FedAccounts, there is no shortage of “unconventional” thinking. Public banking is also regaining traction. Most significant from a left perspective has been the rise of Modern Monetary Theory (MMT), a body of thought based on the idea, known as chartalism, that money is fundamentally a creature of the state rather than the market. In the COVID era, MMT has definitively jumped into mainstream macroeconomic debates and left-leaning policy circles. The MMT economist Stephanie Kelton, for example, is a prominent Bernie Sanders adviser who served on the “unity task force” convened by Joe Biden, the Democratic nominee.

Some on the left are wary of MMT because it appears to offer simplistic slogans (“deficits don’t matter”) for difficult problems of political economy. Appraised with Shaw’s story in mind, however, it looks like an effective way to combat orthodox financial pieties (“how you gonna pay for that?”). Among heterodox ideas, MMT has probably made the most progress toward achieving the third condition suggested by Shaw’s book: political clout. Besides Kelton’s position with Sanders, there is Rashida Tlaib’s and Pramila Jayapal’s outlandishly ambitious Automatic BOOST to Communities (ABC) Act. The bill would provide every person in the country with a $2,000 cash card to be automatically re-upped with $1,000 every month until a full year after the health crisis has passed. The MMT kicker is that the Treasury Department would fund it by simply minting two trillion-dollar platinum coins. If this sounds like a political stunt, that is because it sort of is. It comes complete with the hashtag-ready slogan #MintTheCoin, intended as much to educate the public as to sway members of Congress. MMT also has some attributes of a social movement, with dedicated supporters mixing it up on Twitter and popularizing its ideas through an extensive network of blogs and podcasts. This is reminiscent of the rabble-rousing combativeness that Shaw puts at the core of banking politics.

Regardless of whether MMT is the right approach, it carries on a venerable American tradition of confronting the specifically financial aspects of the economic status quo. It is the same tradition that put a state-owned bank in deep-red North Dakota. Talking about how to make money function in the interests of ordinary people might seem distasteful or wrongheaded to those of us committed to the proposition that America’s problem is precisely its obsession with money. But money is ultimately the way that we distribute and account for a big part of our social claims on one another. Money, Power, and the People reminds us that the rules of the monetary system are too important to be left to financial elites. Crucially, it also inspires confidence that when ordinary people speak up, they often come up with better plans.

Ariel Ron is a history professor at SMU in Dallas. His book, Grassroots Leviathan: Agricultural Reform and the Rural North in the Slaveholding Republic, is out in November from Johns Hopkins University Press.