Can We Remake Finance?

Can We Remake Finance?

We have witnessed the destructive effects of financialization. Can the millions held in bank deposits, corporate equities, and bonds be used instead to provide for society’s most pressing needs?

Democracy in Default: Finance and the Rise of Neoliberalism in America

by Brian Judge

Columbia University Press, 2024, 352 pp.

The Master’s Tools: How Finance Wrecked Democracy (and a Radical Plan to Rebuild It)

by Michael A. McCarthy

Verso Books, 2025, 272 pp.

While there is a broad consensus that we have been living in a neoliberal era since the late 1970s, there is little agreement on what to do about it. Authors on the left often come to diametrically opposed conclusions on questions of strategy. A case in point are new books by Brian Judge and Michael A. McCarthy. Judge ends his book, Democracy in Default, by arguing that proposals to democratize the financial system, including a set of reforms that I put forward with Robert Hockett in Democratizing Finance (2022), are incapable of effectively challenging neoliberal hegemony. In The Master’s Tools, on the other hand, McCarthy elaborates a strategy to use the financial system—the master’s tools—to dismantle the power of markets and oligarchs.

Judge’s book begins promisingly with a critique of the literature on neoliberalism. He argues that most existing analyses on the rise of neoliberalism are agent-centered: they explain the adoption of neoliberal policies—including greater reliance on markets, public-sector austerity, and more lenient regulation of business—as the result of the lobbying and funding of right-wing businesspeople, or the political efforts of Ronald Reagan and Margaret Thatcher, or the theories of Friedrich Hayek, Milton Friedman, and James M. Buchanan. He labels these accounts “neoliberalism by design” and insists they are unable to explain the extraordinary success of the neoliberal project and its feline ability to survive multiple reported encounters with its own death.

Judge reverses the standard causal story in which the rise of neoliberalism leads, both nationally and globally, to rapid financialization (the expansion of the portion of the economy devoted to financial activities like buying and selling stocks, bonds, derivatives, and other assets). Judge argues instead that financialization preceded and largely drove the rise of neoliberal policies and ideas. He shows that politicians from both major U.S. parties opted for financial measures as a way to solve intensifying distributional conflicts between capital and labor in the 1960s and 1970s—a moment when the postwar growth model based on suburbanization, cheap oil, and military spending was exhausted.

One of Judge’s examples is the creation of new government-sponsored enterprises (GSEs) in the late 1960s whose task was to purchase mortgages from banks, so that financial institutions could get older mortgages off their books and increase the number of new ones. These GSEs pioneered the process of bundling mortgages into bonds to sell to investors. It was similar collateralized debt obligation bonds, composed of subprime mortgages, that blew up the world economy in 2008. Judge is arguing that once the process of financialization gets started, it takes on a life of its own, ultimately intensifying the distributional conflicts that it was meant to resolve.

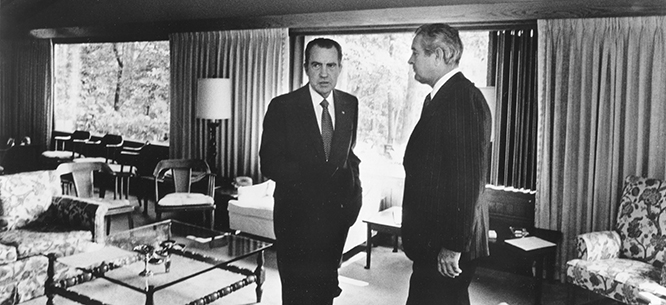

While Judge does not emphasize it, the breakdown of the Bretton Woods system of fixed exchange rates in 1973 strongly supports his case. Most of Richard Nixon’s economic advisors believed that the Bretton Woods commitment to fixed exchange rates was more stable than the system of floating rates long advocated by Milton Friedman and his colleagues at the University of Chicago. However, those advisors were unable to persuade major European trading partners to allow a devaluation of the dollar that was large enough to rebalance the U.S. accounts. They opted for floating rates in March 1973 as a tactic to force the Europeans to negotiate a more favorable fixed exchange rate for the dollar.

This happened precisely when the Watergate crisis was threatening Nixon’s presidency. In June 1972 Nixon was recorded saying, “I don’t give a shit about the lira” (Italy’s currency at the time). As he struggled over the next eighteen months to save his presidency, he probably would have said the same thing about exchange rates more generally. There were no serious international discussions over exchange rates until well into the administration of Nixon’s successor, Gerald Ford. While the United States was preoccupied with Watergate and its aftermath, the rest of the world figured out how to adapt to floating exchange rates. What had been a temporary negotiating tactic became the new normal, formalized by the International Monetary Fund in January 1976.

Floating exchange rates are themselves a form of financialization: foreign exchange traders at big banks were now able to make enormous bets on which currencies were likely to rise or fall. The shift drove even more financialization as key exchange rates, such as the one between the German mark and the U.S. dollar, became far more volatile.

This volatility opened the door to neoliberal policies in a number of ways. First, many nations had until this point retained some capital controls that limited the ability of individuals and firms to move funds across borders. As exchange rate volatility increased, firms and businesses lobbied successfully to dismantle controls that restricted their ability to protect the value of their investments relative to other currencies. (The effect was even more volatility.) Second, markets opened up to allow investors to manage shifts in exchange rates or interest rates with various derivative instruments. Speculation in these instruments makes it easier and cheaper for bond vigilantes to press economic orthodoxy on governments. Third, the European Community began moving toward a common currency because internal trade was jeopardized by volatile exchange rates. And because this common currency was adopted without a closer political union, it has reinforced the pressure for budget austerity throughout Europe.

Theorists and activists were already pushing for neoliberal policies before the financialization of the economy, but they would not have succeeded had it not been for shifts at the structural level that occurred independently of their efforts. Or to put it slightly differently, the various crises of the Keynesian model of economic management that had sustained the thirty glorious years following the Second World War drove policymakers to finance-friendly policies that, in turn, opened space for the neoliberal agenda.

However, Judge wants to push this argument even further. He insists that because liberalism as an ideology separates the realm of the economy from the realm of government, liberal governance lacks the ability to manage and reconcile distributive conflicts. When such conflicts reemerged in the 1960s and 1970s, politicians (including both Republicans and Democrats in the United States) turned to finance as a way to manage and defuse these conflicts.

This is why Judge is skeptical of proposals to democratize finance. For him, the fundamental problem is that liberalism blocks any significant debate over the distribution of economic benefits. “In the pairing of liberal democracy, democratic control is always subordinate to the liberal imperative of depoliticizing distributive conflict,” he writes. “Without breaking free from these deeper liberal structures, the emancipatory potential of democracy is seriously limited.” While Judge stops short of saying it, the implication is that a radical break with liberalism is the only path to a more egalitarian distribution of income and wealth.

For Judge, liberalism is a system of governance that does the work that orthodox Marxists attribute to capitalism. But that means he has to ignore a good deal of twentieth-century history. What, after all, was the New Deal but an effort within liberalism to resolve distributional conflicts by channeling more income to workers and farmers? Moreover, we know from Thomas Piketty that from 1910 to 1970, government policies significantly diminished income and wealth inequality in a number of places that could be described as liberal democracies. Many of these gains were ultimately reversed in the neoliberal era, but the fact that they were initially won suggests that liberalism is more flexible than Judge’s diagnosis.

His argument goes off the rails in his analysis of the 1970s crisis. He correctly argues that various political leaders resorted to finance as a quick political fix for intensifying distributional conflicts. But it does not follow that there were no other strategies for restoring growth and managing these conflicts. It is important not to confuse a lack of political imagination or the weakness of left-wing forces for historical inevitability.

This is where The Master’s Tools is so relevant. Michael McCarthy argues that we are in yet another period in which the dominant growth model has been exhausted, and a radical Green New Deal is necessary to move out of this impasse. He also rejects the claim that no significant reforms can be won in our moment unless capitalism has first been overturned. “Capitalist politics are not static, ahistorical constraints on human flourishing,” he writes, “but are constituted historically and change over time and across space.” He builds on André Gorz’s idea of “nonreformist reforms” to outline a program to use the master’s tools—the financial system—to shift the balance of class forces in favor of workers and their allies.

McCarthy explains in considerable detail the predatory and destructive effects of financialization—an economic model that fails to provide for many of society’s most pressing needs. However, he also understands that people in the United States hold many trillions of dollars in bank deposits, corporate equities, and bonds. If only a fraction of these holdings were transferred to nonprofit financial institutions committed to clean energy, infrastructure for resilience, affordable housing, and expanded social services, a new growth model might be viable.

Judge believes, as Audre Lorde put it, that “the master’s tools will never dismantle the master’s house.” He shows how California politicians repeatedly pushed the state’s big public pension program, CalPERS, to increase its rate of financial return so as to reduce the amount that government had to put aside for pensions. That led CalPERS to increase the share of its portfolio going into more speculative and destructive investments, including private equity. From this example, Judge concludes that public financial institutions will always be as profit-driven as private ones.

There is ample evidence from public banks around the world that this is not the case. McCarthy, in contrast, recognizes that public financial institutions that are happy with returns of 3 or 4 percent on their investments could finance a wide range of activities that private institutions would never touch. Germany’s nonprofit banks, for example, have played a key role in the strength of its small and medium-sized manufacturing firms.

However, McCarthy recognizes the danger of these public financial institutions adopting the same behaviors as their for-profit counterparts. He emphasizes that these public financial institutions must be managed in the public interest—and be held accountable to the public. Finding most of the available mechanisms for achieving democratic accountability to be imperfect and vulnerable to elite capture, he suggests sortition, a system of random selection that was first used in ancient Athens to fill political offices.

In McCarthy’s vision of financial reform, citizen assemblies (“mini-publics”) chosen by lot would make key decisions about infrastructure and investment priorities. And each participating financial institution would have an oversight board, also chosen by lot, that holds veto power over decisions made by management.

McCarthy draws here on recent experiments using random selection to convene citizen assemblies to advise governments on critical decisions. One region in Belgium has even created a permanent popular assembly that “has the power to create one-time citizen assemblies to take up issues and concerns and then bring them to Parliament.” These experiments show that when citizens are presented with different views and given the opportunity to deliberate, they are able to devise solutions that are broadly popular among voters. But that still leaves open whether random selection would work effectively to exercise oversight on the managers of public financial institutions.

Some on the left have argued for the creation of what Saule Omarova calls a National Investment Authority to oversee a dramatic increase in productive public spending. But such a centralized authority would concentrate enormous political power in a small number of hands, who could seek to translate that power into wealth and other privileges. McCarthy recognizes that just as the power to tax is the power to destroy, so is the decision to withhold financing. For that reason, he seeks to decentralize this power across a wide network of public financial institutions.

Both Judge’s definitive break with the liberal model and McCarthy’s proposal to redeploy the master’s tools might be little more than science fiction given current political constraints. But while the U.S. government has swung sharply to the far right under Donald Trump’s second administration, who is to say that a comparable swing to the left is impossible after Trump and his oligarchic pals have wrecked the country? If that happens, it is McCarthy’s book that would provide a roadmap for how to take advantage of the opportunity.

Fred Block’s most recent book is The Habitation Society: Creating Sustainable Prosperity (2025).